Tax-deductible expenses for small businesses

Cash flow is the lifeblood of any new or small business. The need to reinvest, so that your business may become sustainable, is at constant odds with the need to cover your business expenses. However, many entrepreneurs aren’t sure which expenses can be used to reduce their taxable income, which in turn would improve their […]

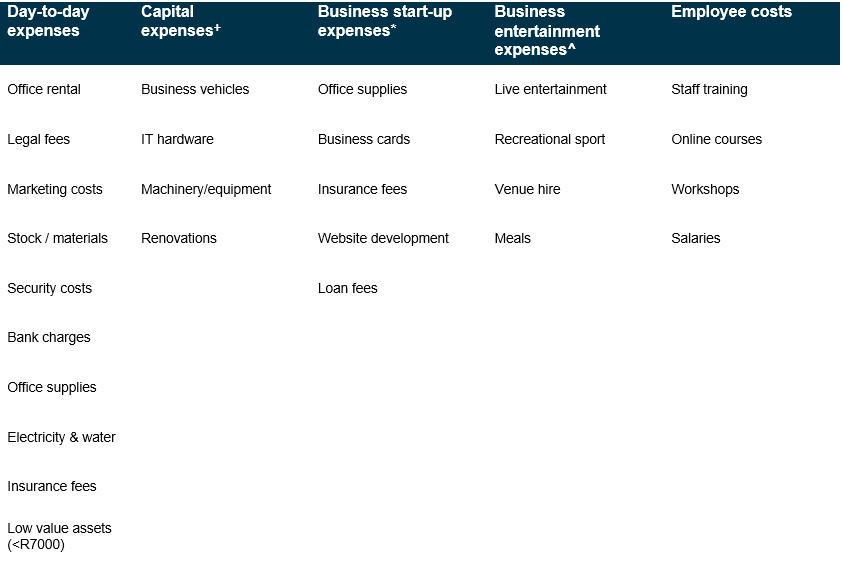

A list of deductible business expenses

Incurring a qualifying business expense and neglecting to use it to reduce the tax you pay is money down the drain. SARS provides the following definition when establishing whether a business expense is tax-deductible. There is one rule, though: it must be an expense incurred in in the production of your business income, but not of a capital nature. Below is a non-exhaustive list of the expenses you may be able to deduct from your taxable income: +Only wear and tear on the qualifying assets may be allowed as a deduction as set out in SARS Interpretation note 47.

*Incurred before your business began trading, to the extent that said expense would have been allowed as a deduction under S11.

^The onus is on the taxpayer to prove that expenses were incurred in pursuit of business.

You are also permitted to offset any previous operating losses incurred by your business against your taxable income in the current year, provided an active trade or business of a similar nature is carried on without interruption.

Given the varied nature of commerce, some of these expenses will be necessary in the operation of your business, and others won’t. The best approach would be to think of every expense as an opportunity to reduce your taxable income, and then to either verify the deductibility yourself or run it past a certified tax practitioner.

Most often you can deduct the full, qualifying expense in the year it is incurred. But there are cases where the deductible amount doesn’t come so easy.

+Only wear and tear on the qualifying assets may be allowed as a deduction as set out in SARS Interpretation note 47.

*Incurred before your business began trading, to the extent that said expense would have been allowed as a deduction under S11.

^The onus is on the taxpayer to prove that expenses were incurred in pursuit of business.

You are also permitted to offset any previous operating losses incurred by your business against your taxable income in the current year, provided an active trade or business of a similar nature is carried on without interruption.

Given the varied nature of commerce, some of these expenses will be necessary in the operation of your business, and others won’t. The best approach would be to think of every expense as an opportunity to reduce your taxable income, and then to either verify the deductibility yourself or run it past a certified tax practitioner.

Most often you can deduct the full, qualifying expense in the year it is incurred. But there are cases where the deductible amount doesn’t come so easy.

Nuanced tax-deductible expenses

Let’s assume you have decided to start a physiotherapy practice, which you will run from your home. Wear and Tear (Depreciation): To get your business ready for operation, you’ll need to buy equipment like treatment beds, ultrasound machines, and a computer. Asset costs not exceeding R7,000 can be deducted in full, but any asset that costs more than R7,000 is considered a ‘capital’ expense and must be written off over time. The value the asset loses each year through wear-and-tear is tax-deductible. SARS has compiled a comprehensive document (interpretation note) detailing which assets qualify and how to calculate the annual wear and tear figure thereon. Home office expenses: Because you’re running your physiotherapy practice from home, there’ll likely be household expenses that, in essence, contribute to the operation of your business. Water and electricity, building insurance, and Wi-Fi costs are but a few examples. As a result, you are permitted to deduct the portion of these expenses that are applicable to running your business. A general rule of thumb is to work out the size of your office space as a percentage of the total square meterage of your house and then multiply any qualifying costs by that percentage to get to your tax-deductible amount. Licenses: You are required to have a license to run a physiotherapy practice. If the license is valid for only one year, then the full amount will be deductible in the year it was incurred. But if the license is valid for a multiyear period, the annual deduction may not exceed the total cost of the license divided by the number of years for which the license will remain in effect.It’s all about record keeping

An in-depth understanding of which expenses can be deducted from your taxable income is a great starting point – but it won’t mean anything unless that knowledge is matched by a precise record-keeping regime. Here are some examples of the records you must keep:- Copies of both the invoice and receipt (as proof that you made the payment) for any qualifying expense that you want to deduct from your taxable income.

- A schedule of your entertainment expenses which includes the date, who you entertained, the purposes of that entertainment (prospecting, new project, etc.), the venue, and the cost – this will make it easier to prove to SARS that the expenses were genuinely business-related.

- Depreciation schedule showing how you calculated the annual amounts deducted from your taxable income. Make sure you have the proof of purchase (invoice) of the asset in question.

- Any expenses you claim that have to do with travel (fuel, toll fees) or vehicles (repairs, insurance) must be backed by a logbook that details your odometer reading at the start and end of the financial year, the business mileage you accumulated during the year, and the details around each trip taken (date, reason for travel, distance covered). This will allow you to calculate the portion of deductible travel/vehicle expenses applicable to your business activity.

The quick guide to payroll compliance

Advice from experts on how to manage and maintain payroll compliance. Managing the many aspects of payroll compliance can be tricky with the landscape of rules changing so often. While changes to PAYE are routine, legislative complexity makes it difficult to keep tabs on everything. The consequences for failure to maintain compliance hits businesses where they feel it most: their time and their wallets.