Payroll tax deductions: dispelling five myths

There are several myths and misconceptions about payroll tax in South Africa that won’t go away. Here are five myths and what the tax and labour laws actually say. Myth 1: Salary is taxed differently from overtime or commission No matter whether your employer calls what it pays you a salary, overtime or commission, it […]

There are several myths and misconceptions about payroll tax in South Africa that won’t go away. Here are five myths and what the tax and labour laws actually say.

Myth 1: Salary is taxed differently from overtime or commission

No matter whether your employer calls what it pays you a salary, overtime or commission, it is taxed at the same rate on the payroll according to the standard PAYE tax tables. There will be a different code on the tax certificate to let SARS know what the payment is for, but there are certainly no different tax rates for different types of remuneration.

Allowances such as your travel allowance are also taxed at the same rate. However, only a portion of the allowance may be included in the tax calculation, depending on what the allowance is for. For example, either 20% or 80% of a travel allowance is included in the tax calculation on the payroll, depending on how much business travel you do.

Some payments, such as a retrenchment package, might not be taxed on the payroll because there is a once-off R500 000 lifetime exemption for lumpsum payments in respect of retrenchment, retirement or death. The employer must apply for a directive from SARS to determine whether you have used the exemption before.

Myth 2: Bonuses don’t get taxed

If you are one of the lucky few to get an end-of-year bonus this year, it is taxed at the same rate as other remuneration. To determine the rate at which you should be taxed on the payroll and calculate tax for the year, the bonus will be added to your annual salary. This will determine the amount of tax you should pay for the full tax year.

From there, it can subtract your usual annual PAYE deductions, based on remuneration received monthly, from the total to determine how much tax you should pay on your bonus and your PAYE for the month.

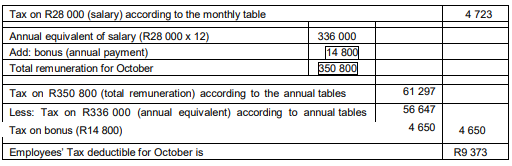

The table below is an example from the SARS Guide for employers in respect of employees’ tax. A monthly paid employee (below 65) received a salary of R28 000 and a bonus of R14 800 in October:

Sometimes the bonus can nudge you into a higher tax bracket, and that portion of your income will be taxed at a higher rate. Bear in mind these calculations would usually be done automatically by your employer’s payroll software.

Myth 3: The employer must pay out all leave due

According to section 40 of the Basic Conditions of Employment Act (BCEA), each employee working an eight-hour day and a five-day week is entitled to 21 consecutive days of paid annual leave. Leave which accrued to the employee under this entitlement, but was not taken, must be paid out to the employee on termination.

However, the BCEA does not regulate what should happen with annual leave that exceeds the minimum specified in the Act.

If you accrue more than 15 working days in a year, your employer does not have to pay the excess leave days when you leave the organisation. Your employer may, however, specify in your employment contract that the additional days will be paid out if you leave without using them.

You may also not sell days of your minimum leave to your employer. In other words, work your leave days to get paid more money. You may only sell leave exceeding the 15 days of minimum leave as per the BCEA.

Myth 4: A travel allowance (company or private vehicle) is treated the same

A travel allowance is provided to the employee to cover business travel expenses. In practice, the allowance is generally provided to an employee making use of their own private vehicle, but there is no requirement that the employee must own it. The employee will be allowed a tax deduction against the travel allowance for the costs of business travel.

However, if a travel allowance is provided for an employer-provided vehicle (company car), no deduction will be allowed on assessment. It should be reflected on the payroll as a taxable allowance rather than a travel allowance.

A deduction for business travel will be allowed against the use of motor vehicle fringe benefit, on which the employee was taxed monthly.

Myth 5: An employee petrol card is taxed differently to a travel allowance

If the employee makes use of a company-owned petrol or garage card, in respect of a private vehicle, then the tax treatment on the payroll is the same as when the employee would receive a travel allowance. The only difference is that the allowance and the taxable amount may vary by month.

Quick start guide to Payroll Tax Year-End

We understand your day-to-day challenges; which is why we want to try and make your business life easier. We’ve prepared this guide to help you work more efficiently, giving you more time to do what you do best – run, manage and grow your business.