The cost-efficient SaaS CFO: slash your burn rate

Become a cost-efficient SaaS CFO with our expert tips. Learn how to slash your burn rate and extend your cash runway.

We can all agree that overspending can lead to SERIOUS personal regret. But as a SaaS CFO, careless spending puts you at risk of more than just buyer’s remorse. You could run your company into the ground if you’re not careful.

In this blog post, we’ll 1) Cover everything you need to know about managing your burn rate as a SaaS CFO, 2) Explain the difference between gross and net burn and why it’s crucial to monitor them in real time, 3) Share some practical steps you can take to minimise your burn rate.

If you’re ready to embrace cost-efficient financial leadership, this post is for you.

Understanding your company’s burn rate

Analysing cash flow is a crucial responsibility for SaaS CFOs, and you can’t get the full story without your burn rate. Also known as cash burn rate, it measures how much cash your company burns through in a month. Calculating it is as simple as adding up the total amount of money your company spends monthly.

Your burn rate is an important metric for expense management. As a measure of negative cash flow, it can help you:

- Work to establish cash reserves for a rainy day

- Increase your free cash flow to invest in product development

- Steadily work to lower your monthly operating costs

- Have more funds on hand for growth initiatives and penetrating new markets

Why else is monitoring your SaaS company’s burn rate so beneficial?

The importance of tracking your burn rate

Monitoring your organisation’s burn rate helps you ensure financial stability and maximise control over cash flow.

You’ll be better able to identify unnecessary expenses–which might be numerous–and make necessary adjustments to reduce ongoing costs.

And remember, it’s not purely about expense management. The more creative and disciplined you are in slashing your company’s burn rate, the more cash you’ll have available for growth strategies.

In addition to all of that, every stakeholder at your company is counting on you to practice responsible expense monitoring and optimisation.

In a very real way, the success of your entire organisation hinges on keeping your burn rate under control. It’s a truly integral part of building a cash flow positive SaaS startup.

Let’s dive a bit further into these concepts. Gross burn isn’t the only cash burn metric that should be on your radar.

Differentiating your gross burn and net burn

Most of the time, as we mentioned, the terms “cash burn” or “burn rate” are understood to refer to your total monthly expenses. This is also called your gross burn rate or your gross burn.

But there’s another KPI to take into consideration.

In contrast to your gross burn, your net burn takes your revenue into account, showing you the difference between your positive and negative cash flow.

Analyzing both metrics in tandem is essential for measuring the overall financial health of your company.

Efficient usage of net burn in SaaS companies

SaaS CFOs leverage their net burn rate to guide operational efficiency analysis, identifying and cutting unnecessary expenses.

For early-stage startups, measuring your net burn rate at least monthly enables efficient management of cash reserves. In later stages of business growth, quarterly or semi-quarterly burn rate assessments might suffice.

Running regular forecasts on your net burn is a great way of planning for the future and making sure your expenses and cash flow situation are sustainable.

What about your cash runway?

Your cash runway tells you how many months you can cover your current expenses. To calculate your company’s cash runway, divide your cash on hand by your monthly gross burn rate.

The resulting number will tell you how many months your cash runway extends out.

The ideal runway length is subjective, and there’s no “one-size-fits-all” answer.

Your financial leadership style and your company’s unique circumstances will determine what’s right for you. However, keep in mind that investors will look for a cash runway of around 18 months in many cases.

Your cash runway is one area of your business where it generally pays to be conservative. If you can manage it, always aim to have a little more cash on hand than you think you’ll need.

Practical tips to extend your cash runway

Now that you’re better acquainted with the key concepts of your burn rate and your cash runway, it’s time to talk strategy.

As a SaaS CFO, your colleagues rely on you to manage expenses properly and ensure there’s enough cash to cover the company’s ongoing costs and operations.

How can you make sure that happens?

Prioritise growth objectives

We’ve all heard the saying that the best defense is a strong offense. And that’s certainly true when it comes to your SaaS company’s cash runway.

From a strategic point of view, it can be tempting to think of your cash runway in a purely defensive light. After all, the point is to consolidate your financial position to make sure you can cover expenses.

But there’s an equally important element of offense in your cash runway as well. To maximise your runway length, you need to achieve stellar (and sustainable) growth and user satisfaction.

Trimming expenses where you can is extremely important. But without a strong foundational flow of cash, cutting costs won’t be sufficient for long.

It’s not a static balance, either. Depending on factors ranging from your total amount of cash on hand to your monthly revenue and any additional venture capital funding you might have coming in, your offense-to-defense ratio is going to change.

Cloud accounting software provides real-time financial visibility, allowing you to get that ratio right every time and keep your company moving in the right direction.

Nurture existing customer relationships

To maximise positive cash flow and extend your runway, you should give customer retention as much focus as growth. They both carry equal weight for recurring revenue businesses.

By developing customer-centric incentives like loyalty programs or discount campaigns, businesses can maximize renewal rates and upsell opportunities from existing customers.

Additionally, providing exceptional customer service does wonders for building long-term relationships and fostering subscriber loyalty.

The link between automation and burn rate reduction

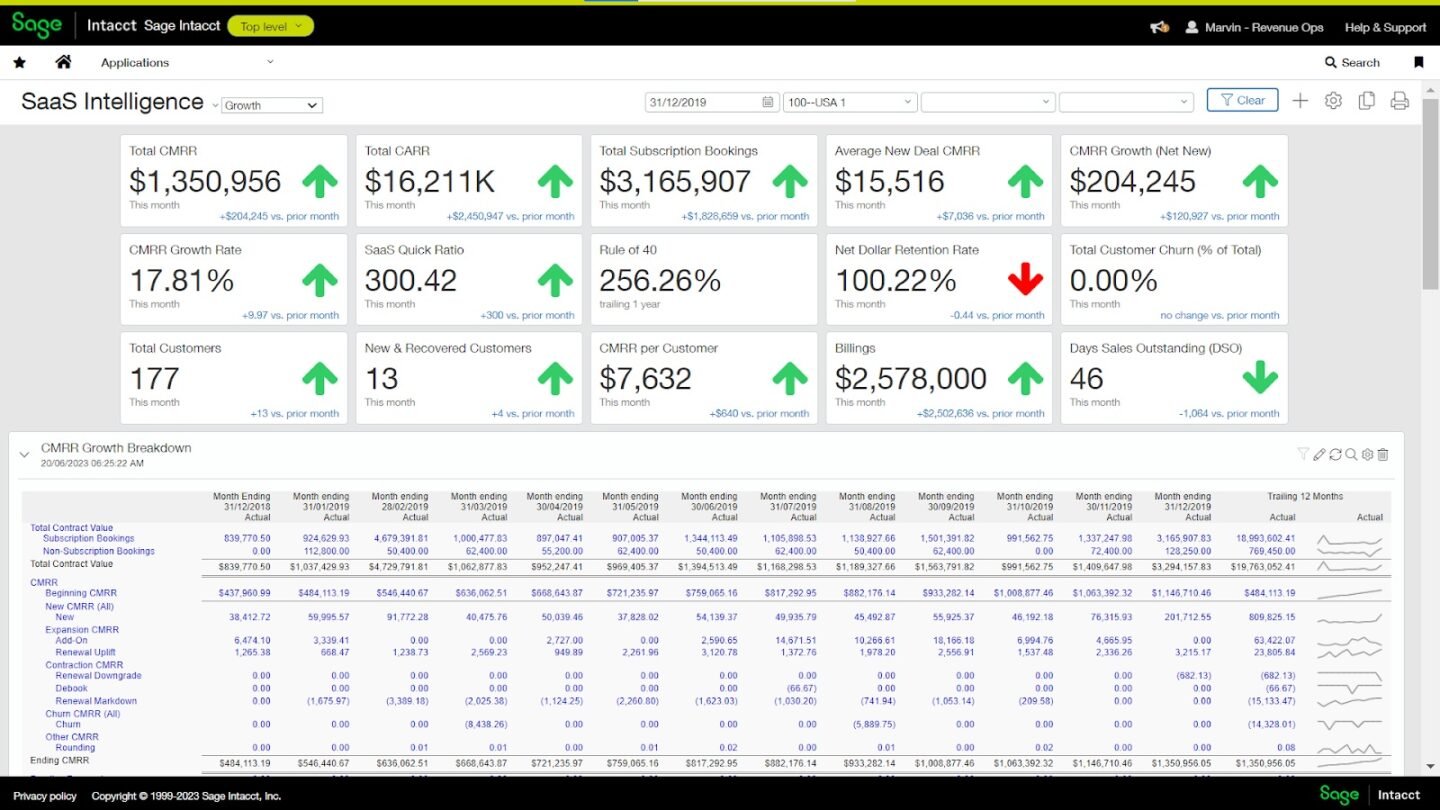

Implementing automation tools for real-time monitoring of your net burn rate is crucial to being a cost-efficient SaaS CFO.

You can’t improve what you can’t see. The remote accessibility of cloud accounting software enables you to see cash coming in and going out at all times.

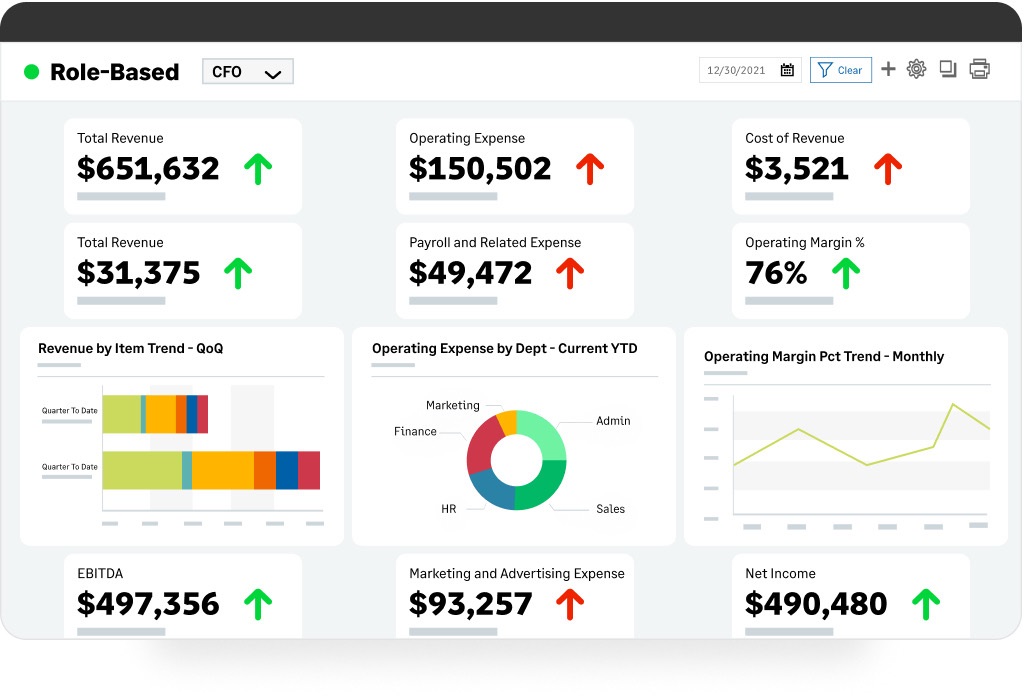

Furthermore, utilising financial dashboards allows for better tracking of monthly expenses and cash flow metrics.

How can switching to cloud automation reduce your monthly net burn and extend your company’s financial runway? Let’s take a look.

The impacts of automation on your cash runway

Automatic expense tracking can eliminate “shadow costs.” Shadow costs refer to payments you’re unknowingly making for products your company signed up for and then stopped using.

SaaS companies rely on many third-party applications, and it can be surprisingly easy to lose track of everything your company is being charged for each month.

Shadow expenses can add up rapidly, causing cash flow drag before you even realise what’s going on.

Beyond preventing you from throwing money away on products you don’t use, AI accounting software can extend your cash runway by:

- Lowering your customer acquisition cost: Automation helps CFOs cut their customer acquisition expenses through effective user targeting, marketing funnel optimisation, and more. The lower your customer acquisition expenses get, the longer your cash runway becomes.

- Increasing your customer lifetime value: Increasing the amount of money your subscribers generate before they churn can help you shore up your cash reserves. Cloud accounting software helps boost subscription revenue through automated product recommender systems, user segmentation for upsell offers, customer sentiment analysis, and more.

- Upgrading your forecasting capabilities: Automated forecasts are more accurate, faster to create, and produce further-range forecasts than their manual counterparts. Forecasting is essential for gauging the effect of various financial decisions on your runway.

Being a truly effective SaaS CFO requires being a cost-efficient finance leader. And in this day and age, it’s growing increasingly difficult to meet that standard with manual tools.

Embrace AI to slash your burn rate

We feel it’s important to emphasise this: how much money constitutes “enough of a cash runway” or a “good burn rate” is highly subjective. Are you in the early stages of growth? What’s your ratio of monthly operating expenses to subscription cash inflows? Do you have a lot of office space or other sizable expenses on your financial statements?

Clearly, there’s a lot to consider, but AI can help you get it right. Accounting automation software can minimize your company’s monthly burn rate by tracking expenses with laser focus. To learn more, check out our datasheet about automated SaaS spend management.