SaaS metrics: the key to CFO success

Unlock the power of SaaS metrics for CFO success. Get expert insights on boosting subscription cash flow with KPIs.

As a SaaS CFO, you can count on at least one thing every day you show up to work: UNCERTAINTY. What will your cash flow look like in three months? A year from now? Will your annual subscriptions hold steady (or hopefully grow)? Are you spending too much money to acquire new users?

Your SaaS metrics can help you figure all that out and much more. Finance leaders use key performance indicators (KPIs) to track cash flow and reduce the level of uncertainty they face.

In this post, we’ll cover 1) Essential SaaS metrics you should be monitoring, 2) Why these metrics are so useful for financial strategizing, and 3) Steps to streamline your KPI management. Let’s begin.

What are SaaS metrics?

SaaS metrics are financial indicators that help you track the success of your subscription model and monitor your company’s growth.

There are various categories of metrics, each meant to measure a different aspect of SaaS business performance.

Some major KPI categories include:

- Revenue metrics: As the name implies, your revenue metrics measure your cash flow. For recurring revenue SaaS companies, this category includes annual recurring revenue (ARR), monthly recurring revenue (MRR), and various MRR subsets.

- Customer engagement metrics: These metrics track your customers’ level of engagement with and interest in your products. Primary examples are churn and average monthly use logged per customer.

- Efficiency metrics: Your efficiency metrics tell you how efficiently you use your resources to scale and reach your objectives. Your customer acquisition cost (CAC) is a prime example.

So, what’s the big deal about SaaS metrics? Why should you take the time to carefully monitor them for your subscription business?

The importance of your SaaS metrics in financial strategizing

Your KPIs are all about reducing financial uncertainty. As a SaaS finance leader, that goal should always be top of mind.

How do your metrics help you achieve it, and what’s their role in your professional success?

Your company’s metrics are a foundational part of forecasts.

SaaS forecasting helps you get a grip on your unknowns. But to make that happen, you have to start with financially objective data. That’s where your KPIs enter the picture.

Tracking and monitoring your SaaS metrics is necessary but insufficient for maximizing cash flow. You also need to use them as the building blocks for strategic SaaS forecasting.

This is where the true utility of KPIs becomes apparent. Your metrics help you forecast the impact of different pricing and billing decisions, your future cash flow and renewal rates, and countless other things.

RELATED: Modernize Your Forecasting: SaaS Forecasting for CFOs

Your SaaS metrics help you set profitable budgets.

In addition to forecasting, budgeting is another pillar of your workplace responsibilities. Setting an actionable SaaS budget is next to impossible without consulting your KPIs first to see how your previous allocations worked out.

Your metrics tell a story, and setting a successful budget requires paying close attention to that narrative. Proper allocations improve customer retention and boost your bottom line. On the other hand, poor budgeting calls could put a serious damper on growth.

If you haphazardly dump a bunch of cash into a product line that’s not gaining any traction, you’ll likely get nowhere. Consulting your metrics for budgeting purposes can help you avoid that and innumerable other pitfalls.

KPIs are valuable fundraising tools and help you track performance obligations.

When your company takes external funding from investors, that cash has performance obligations attached to it. If you can’t hit the benchmarks your investors expect, they won’t be around for long.

Your metrics provide an objective touchpoint to help you gauge where you are and how that stacks up to what your shareholders expect.

Now that you’ve got more context on why metrics matter and how they inform your business decisions, let’s get into some specific KPIs.

5 SaaS metrics you should be tracking:

It’s fine to know that you should be tracking your KPIs, but where do you begin? Below, we cover five key SaaS metrics you should be monitoring.

- ARR: Sometimes referred to as the “holy grail” of SaaS metrics, your ARR tells you how much revenue your company generates in a particular year. It’s usually the first place investors look when gauging a subscription company’s profitability, as it provides a snapshot of financial health and customer satisfaction. Though, as we’ll see, a lot more goes into staying financially healthy.

- MRR: Your MRR is what your ARR breaks down into, with twelve months of MRR for every year your company is operational. Investors care greatly about MRR because it signals a healthy cash flow.

- CAC: Your CAC tells you the average amount of money your business spends to acquire each new user. The lower you get this metric, the more free cash flow you’ll have available.

- LTV: Your customer lifetime value (LTV) tells you the average revenue each customer generates before churning. CFOs often combine CAC and LTV into the “CAC/LTV ratio,” aiming to cut CAC and max out LTV.

- Efficiency score: The efficiency score is a metric Bessemer uses to calculate the overall efficiency with which a company handles its resources. Note that this differs from your CAC, which only measures how efficiently you onboard new users. To find your Bessemer efficiency score, divide your net new ARR by your net burn. In other words, divide your newly committed annual revenue by your total annual expenses. Bessemer categorizes a score of 0.5 as “good,” 0.5-1.5 as “better,” and 1.5 and above as ideal.

Let’s dive deeper into the first two metrics on our list: ARR and MRR.

SaaS recurring revenue metrics

Optimizing your recurring revenue metrics is crucial for maximizing cash flow. Your company’s financial performance will suffer unless you can turn your revenue into recurring revenue.

Recurring revenue is a significant marker of cash flow stability, ensuring you have enough funds for operations, growth, and customer service. As we noted earlier, SaaS recurring revenue breaks down into ARR and MRR.

They play different but equally critical roles in your long-term profitability.

Decoding your ARR

The second “R” in ARR is the most important part of this metric. The fact that ARR measures committed recurring revenue distinguishes it from AR, which measures the sum total of a given year’s revenue.

In light of their high cash flow generation, products with particularly strong ARR represent top candidates for cross-selling to other users.

By the same token, the audience segment or segments that account for most of your ARR are your best bet for upselling and cross-selling efforts. They’re engaged and love what you do.

MRR: Why does it matter?

Your MRR tells you how much recurring revenue your company generates monthly. To get the full picture of your company’s revenue growth, you need to look at various MRR subsets, including:

- New MRR: Your new MRR measures how much committed monthly revenue you generate from new signups in a month.

- Expansion MRR: This KPI tracks your company’s monthly revenue increase from cross-sells, add-ons, and account upgrades.

- Churn MRR: Your churn MRR tells you how much monthly revenue you lost to logo churn.

SaaS CFOs use MRR and its various subsets to track the shorter-term success of their business model and make sure their companies have enough cash coming in.

Paying attention to these various MRR metrics is also essential in keeping your churn rate low since they alert you to problems or fluctuations early on.

Tracking your metrics is always a great idea. But you need to use the right tools, or you’ll waste a ton of time and money–and not see the renewal and cash flow results you’re after. How can you avoid that?

How can SaaS CFOs improve KPI management?

By leveraging cloud accounting software with AI, you can streamline your KPI management and significantly increase the level of financial predictability in your department.

What does cloud accounting software do for your KPI monitoring and financial decision-making?

Cloud tools offer real-time, continuous visibility into your SaaS metrics.

Manually updating and tracking your SaaS metrics takes a lot of effort (read: labor and cash).

It’s also prone to terrible lag, with KPIs often being outdated by the time you see them.

Cloud software with accounting AI gives you full integration with your SaaS metrics. No lag, just real-time data whenever you need it.

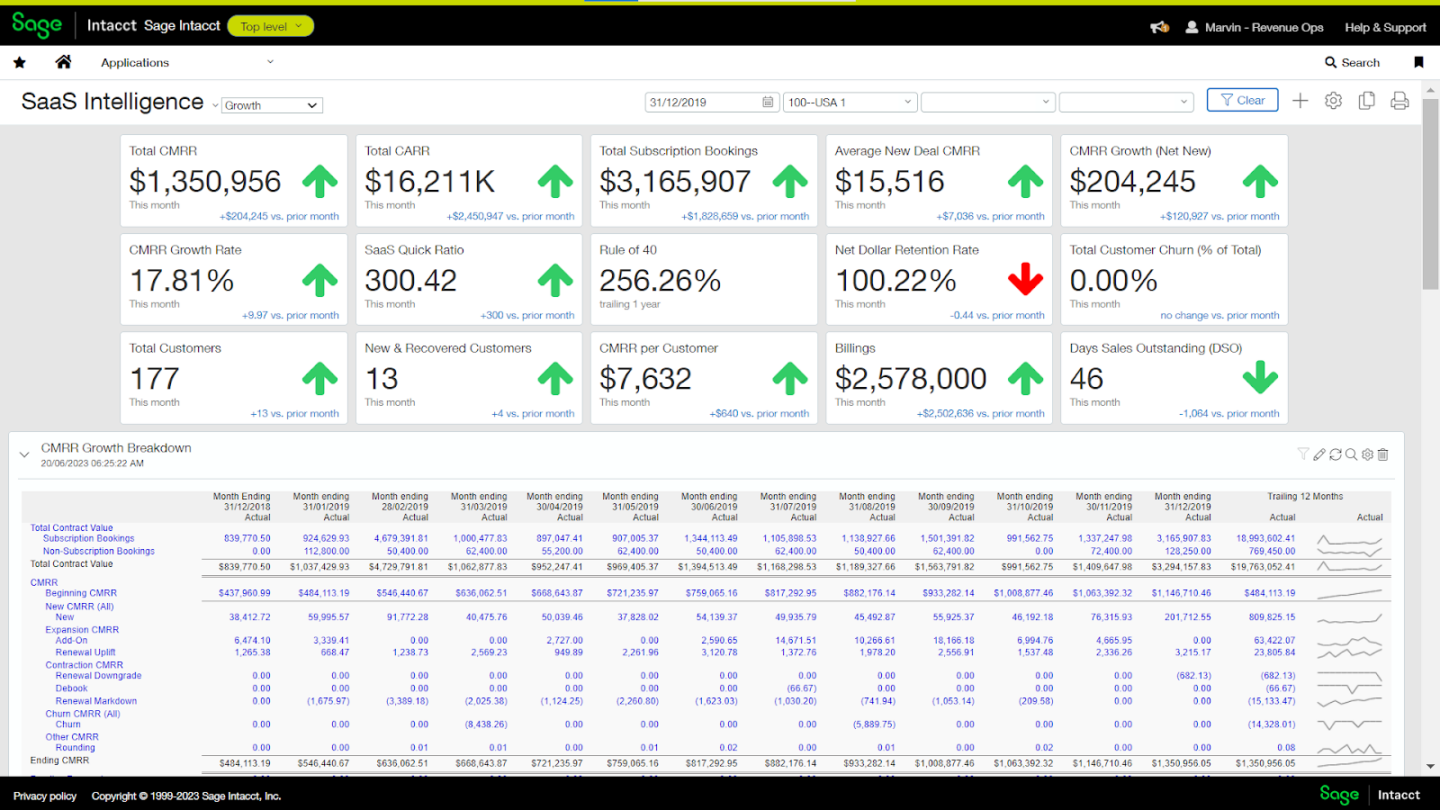

Role-based dashboards save time and hassle.

AI accounting software features role-based dashboards for SaaS CFOs and other finance leaders. These customizable screens conveniently centralize all the metrics you need for financial success.

With role-based dashboards, one glance is all it takes to get up to speed.

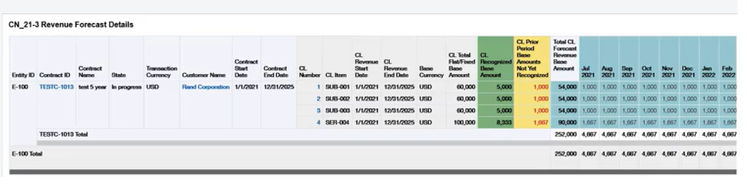

Regularly run automated forecasts for your SaaS metrics and KPIs.

Forecasting your SaaS metrics is one of the most important things you can do as a CFO.

Automated forecasts created with ML algorithms use dynamic forecast modeling. This means that your KPI forecasts will shift in real time as your financial environment changes.

Dynamic cloud-based forecasting gives you an ongoing and evolving sense of where your metrics are headed. When it comes to increasing cash flow, that makes all the difference.

Prioritize metrics and profits will follow

Your SaaS metrics are too important to leave to chance. They underpin virtually every professional decision you make across the fiscal year.

You and your finance team deal with enough uncertainty on a day-to-day basis. When it comes to your key metrics, you shouldn’t have to put up with any. And thanks to accounting AI, you don’t need to.

To learn more about the impact your metrics can have on your company’s success, check out our video on using your KPIs to tell your story to VC investors.

Sage Intacct SaaS intelligence

To learn more about the impact your metrics can have on your company’s success, check out our video on using your KPIs to tell your story to VC investors.