How to recover a past due invoice

When an invoice doesn’t get paid on time and payment is overdue, it’s not just the lack of funds coming into your business that’s costly. The time and effort that goes into chasing past due invoices reduces the amount of time you can focus on all the other important tasks required for running your business.

Your best strategy for tackling delayed invoices, and maintaining a positive cash flow, is to make paying the invoice as easy and straightforward as possible.

One way to do this is to use accounting and invoicing software that allows payments to be taken directly from your invoice. Creating invoices that are well-formatted and error-free will also help you get paid on time.

Even with your best efforts, there will be times when a client or customer doesn’t pay their invoice, for whatever reason. Amazingly, our survey of 300 US-based SMBs found that 34% of customers have no reason for delaying invoice payments.

Follow our guide below to help you recover your past due invoices.

How to ask for payment and follow-up on a past due invoice

Before you begin to recover a past due invoice

A good starting point is to look at the invoice you sent to make sure all the information you provided is correct. For example:

- Check the invoice date and payment amounts.

- Check the customer’s details (name, trade name and address) are correct.

- Check the payment details you provided.

If you’re forced to collect outstanding invoices through legal means, you’ll need to prove that you followed a fair process. Make sure you record all communications to ensure that you have sufficient evidence to back your claim.

For example, note the date and person you spoke to during any phone calls. Follow-up with an email with a summary of the conversation and ask your client for confirmation.

Sending payment reminders and chasing past due invoices

Send the invoice and establish the due date.

Let’s say you submit an invoice on April 1 with a 30-day net invoice payment terms.

After 30 days, on April 30, payment is due.

After two days:

Send a past due invoice email.

When sending a follow-up email, remember to:

- Confirm you’re speaking with the right person and get a contact name for accounts payable.

- Offer a friendly reminder and ask if they received the original invoice.

- Attach a copy of the original invoice or forward the initial invoice email.

Payment reminder email sample

Email date: May 2, 2019

________________________________

Email subject: Past due invoice reminder

________________________________

Hello [contact name],

I hope you’re well. I’m following-up on the invoice submitted on April 1, 2019, as it’s now past due.

Do you know when I can expect payment?

You’ll find a copy of the original invoice attached.

Please let me know if you have any questions.

Best regards,

[Your name]

After 7 days:

Send another collection email.

After a week, if you still haven’t received payment, you should send another debt reminder via email. Remain friendly and ask them directly if there’s a reason they haven’t paid yet; for example, an issue with the amounts or services detailed in the invoice.

Collection email sample

Email date: May 9, 2019

___________________________

Email subject: Past due notice

___________________________

Hello [contact name],

I hope you’re well. I wanted to follow-up on the collection email sent on May 2 regarding the outstanding invoice dated April 1, 2019.

Can you please confirm whether there’s an issue with the invoice? If so, I’m happy to discuss it.

I look forward to hearing from you.

Best regards,

[Your name]

After 24 hours:

Follow your second collection notice with a call a day later.

Remember to be friendly and ask if they received your past two past due invoice reminder emails. Then, check they haven’t identified any issues with the invoice and ask directly when you can expect the payment.

_____________________________

Phone call date: May 10, 2019

_____________________________

Hello [customer name]

How are you?

I’m calling to follow-up with you about the invoice I sent over on April 1, 2019. Did you receive my email yesterday?

Are there any issues with the invoice? Were the amount and services detailed correct?

Can you confirm when the payment will be made?

Thank you [customer name], much appreciated.

Immediately after your phone call, create a written summary of the conversation and send it to your client via email. This will create a record of what was agreed, so you can address any disputes and hold them to the commitments they made over the phone.

After 7 days:

Make another phone call to remind your client of the outstanding debt.

- Be fair and reasonable and ask why the payment is delayed.

- Ask when you can expect to receive the overdue payment.

_____________________________

Date of phone call: May 17, 2019

_____________________________

Hello [customer name]

How are you?

I’m calling to follow up on our conversation last week about the outstanding invoice dated April 1, 2019.

Is there any reason the invoice hasn’t been paid?

Can you agree to make the payment by [five days from now] on May 22?

Thank you [customer name].

After you end the phone call, again create a written summary of the conversation and immediately email it to your customer so they can confirm the details.

After 7 more days:

Send a late payment letter.

If your invoice has still not been paid, send a friendly collection letter to your client seven days after the second call. In the payment request letter, explain that their invoice will now accrue interest so the sooner they pay the past due invoice, the less they’ll have to pay. (Note: To charge interest, you’ll need to outline the penalty for late payments in your terms and conditions, which you should share with your client at the beginning of your relationship.)

Collection letter sample

Date of the letter: May 24, 2019

Dear [customer name],

We’re writing to you regarding our invoice dated April 1, 2019, for the sum of [initial cost outlined in invoice] for [work undertaken].

We sent reminder notices to you via email on May 2 and 9. I also spoke to you on the phone on May 10 and 17 to discuss this issue and try to resolve any problems.

You agreed to pay the past due invoice by May 22 [or the date agreed].

You haven’t disputed the issue or flagged any discrepancies with the past due amount.

As outlined in the terms and conditions that were agreed at the start of the project, I am now entitled to charge interest on any balance due. This will now accrue at a rate of $0.27 per day from the date the payment was initially due until the invoice is settled in full.

The total amount payable as of today is $1,006.48.

Please make payment in full immediately to avoid any further action.

Sincerely,

[Your name]

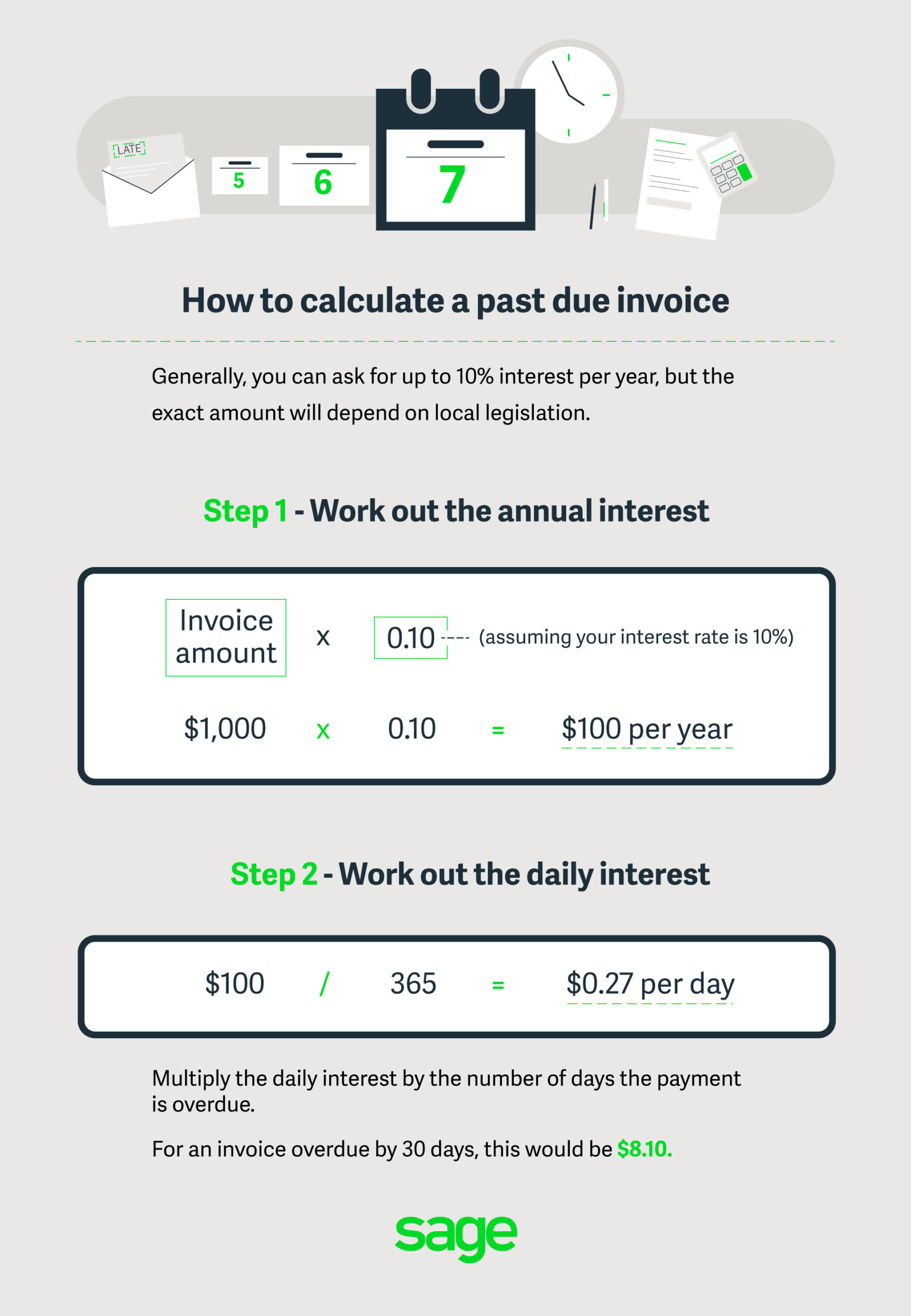

When adding interest, it’s important to check your state laws to see how much you can charge. Generally, you can ask for up to 10% interest per year, but the exact amount will depend on local legislation.

To calculate the daily rate of interest:

Work out the annual interest:

[Invoice amount] x 0.10 (assuming your interest rate is 10%)

$1000 x .10 = $100 per year

Work out the daily interest:

$100/365 = $0.27 per day

For an invoice outstanding by 30 days, this would be $8.10

After 14 days:

Send a final notice letter.

Send a final notice letter or another formal collection letter from your company or company’s lawyer that includes:

- The date of the original invoice

- How much they owe

- What the invoice was for

- The contact name of the person that agreed to the work or approved the goods

- The payment terms agreed

- Make a final request for payment

Inform the customer that you’ll be taking further legal action or progressing the debt to a collection agency if you don’t receive payment within 7 days.

Make sure you can prove the final notice letter was received by using a signed for delivery service.

If you create the collection letter yourself, it might be worthwhile seeking legal advice on how to structure this letter. At this stage, your relationship is probably non-recoverable as you’re unlikely to trust your client to pay future invoices.

Debt recovery options

Once you’ve chased with payment reminder emails, phone calls and written late payment letters, you might need to get outside help. Thankfully, there are a few options for going about this.

Factoring services

If you have a tight liquidity and need to manage your cash flow to get money into your business immediately to cover your overhead, a factoring service might be a good option. With a factoring service, you essentially sell your outstanding invoices for a percentage of the outstanding value while you wait for the rest.

As the percentage you’ll receive can vary widely, typically between 70 to 90%, it’s best to shop around for the best deal. Once you agree to work with a factoring company, you’ll normally receive the funds within a few days.

The factoring company will then take over chasing your customer’s payment and will send you the remainder of the invoice, minus a service fee, once it’s recovered.

Factoring services, unlike collection agencies, conduct a credit check on your customer before purchasing your outstanding invoices. So, if your customer has a poor financial track record, factoring services might not be an option.

Factoring services are also typically best for recovering only one invoice as the service fees are expensive if trying to recover multiple invoices.

Collection agencies

Collection agencies are ideal for recovering very late invoices. Typically, they won’t work with you until the invoice is more than 90 days overdue. Then they’ll take over the chasing process to recover the invoice.

Once funds are received, the collection agency will keep a percentage of the money recovered (typically around 30%). It’s important to remember that the collection service fees are based on the total recovered, rather than the outstanding invoice amount.

So, if you’re owed $1000 and the collection agency recovers $800, they’ll take $240 in service fees, and you’ll only receive $560. And, there’s no guarantee on how much they’ll manage to recover.

Legal action

Deciding to take legal action, like taking the case to small claims court, may depend largely on the overall value of the outstanding invoice.

Suing a non-paying client can be very expensive and quite a lengthy process, so it’s not always worth the time or money.

Before you file a lawsuit, make sure you check with a lawyer to see if it’s worth it and get a better idea of the overall process.

Arbitration

If the contract with your client includes an arbitration or dispute resolution clause, then it’s unlikely that you will need to go to court. Instead, an arbitrator will hear the case and make a legally binding decision.

This is typically quicker than going through the courts and the process is generally less formal.

Small claims court

Smaller debts are usually handled in small claims courts. Every state has different limits on how much can be settled in small claims courts. For example, Kentucky and Rhode Island cap small claims at $2,500, while Alaska and Oklahoma process claims up to $10,000. Check the exact limit for your state.

If your past due invoice exceeds the limit of the small claims court in your state, you can either waive your right to collect anything over that amount or take your claim to a superior court.

Depending on your state, you might not need legal representation to go to a small claims court. However, you should probably still seek legal advice as local lawyers will be able to tell you more about this process and whether a small claims court is suitable for your case.

Superior court

If the past due invoice exceeds the amount allowed in small claims court, you might consider taking your client to a formal state trial court or superior court. It’s relatively rare for debt collection cases to make it to trial as usually non-paying clients settle outside of court.

Get paid on time

While there are certainly some circumstances beyond your control, you can increase your chances of getting paid on time by making sure your invoice is error-free and uses the right layout.

Check out our guide on invoice formatting and templates to learn more about must-have information and other helpful tips for creating an invoice.

You can also streamline the invoicing process by using accounting software. Automating the creation of invoices and tracking what has been paid and what is outstanding will help you manage cash flow and leave you with more time to focus on running your business.

Ask the author a question or share your advice