Quicksilver express courier boosts profitability with breakthrough insights and efficiencies

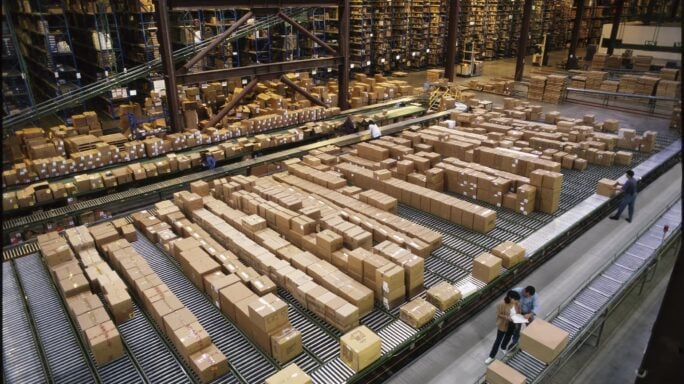

Quicksilver Express Courier has thrived for nearly 40 years through its prowess at handling and delivering packages quickly for thousands of customers in healthcare, printing, law, manufacturing, and many other industries. However, the company, the largest locally-owned courier service in the U.S., wasn’t able to handle its financial data as efficiently and accurately as it addressed customer needs, and its workforce of more than 500 employees. Reliance on an outdated Microsoft Dynamics GP system posed a roadblock as Quicksilver explored options to expand.

“Using Microsoft Dynamics GP became a struggle,” as CFO Maggie Rogness says in our Quicksilver customer success story. “We weren’t getting what we needed out of a system that we were investing quite a bit of money in. In terms of accounting, it just wasn’t efficient.”

A $100,000 Cost Savings on Insurance

An upgrade to Sage Intacct, handled by the ERP consulting firm Maner Solutions, has cleared the roadblock and put Quicksilver on the fast track to modern financial management. Live on Sage Intacct in 2019, Quicksilver has:

- Improved profitability from 5% to up to 25% at some locations with reporting insights

- Eliminated $100,000 in excess insurance costs through reporting insights

- Reduced time needed to close its monthly books 50%, from 28 to 14 days

- Saved weeks of manual work each month on bank reconciliations, intercompany transactions, payroll, and reporting

- Gained agility to adapt to challenges amid COVID-19

“Our move to Sage Intacct has allowed us to streamline our accounting processes and gain new visibility across the company,” said Rogness, a 13-year Quicksilver veteran who became CFO in 2015. “We’re able to look at expanding to new locations and scaling the business with Sage Intacct.”

Moreover, Quicksilver has achieved its “Holy Grail” — individual profit and loss (P&L) reports for each of its hundreds of delivery vehicles generated through robust dimensional reporting in Sage Intacct.

“Now we can see revenue and expenses for every vehicle,” Rogness said. “Through that, we’re able to make decisions based not just on location or department but on vehicles. In the transportation industry, that’s really your bread and butter.”

‘Best and Easiest Implementation Ever’

The Sage Intacct implementation has been transformational for Minneapolis-based Quicksilver, with employee drivers and an overall workforce of more than 500 across locations in Minnesota, Colorado, Arizona, Kansas, Missouri, Montana, and Wisconsin. Quicksilver’s journey began when it received a recommendation from its CPA firm, Olsen Thielen. The company reached out to Maner Solutions, a Sage Intacct partner and the IT consulting arm of Maner Costerisan, a Michigan-based CPA firm.

With the help of Maner Solutions, Quicksilver evaluated Sage Intacct and Oracle NetSuite , but ultimately selected Sage Intacct based on its strong reporting capabilities and open API for easy integration with best-of-breed systems. Rogness and her team quickly struck up personal relationships with Maner Solutions that helped with a fast and straightforward implementation, even with Rogness on maternity leave.

“Sage Intacct with Maner Solutions was by far the best and easiest implementation we’ve ever done, and I was on maternity leave at the time,” Rogness said. “We really appreciated Maner’s transportation industry expertise and their understanding of our company.”

The engagement has been gratifying for Maner Solutions, as Quicksilver capitalized on numerous Sage Intacct capabilities to heighten efficiencies and visibility across the board.

“Quicksilver is a great example of a company that’s modernized their accounting function to be more agile and quickly adapt to new business demands,” said Dave Henson, Maner Solutions business development manager. “Ease of use in Sage Intacct has translated into more efficient processes so Quicksilver can focus on areas of financial impact to grow the company.”

Overall Accounting Efficiency Soars 75%

Rogness agreed that the move to Sage Intacct has made accounting a stronger partner in Quicksilver’s business evolution. “As CFO, I want us to spend less time in transactional details, though I do love the details of accounting,” Rogness said. “But as CFO, it’s important for me to shift away from details so I can focus on bigger and more strategic things. Sage Intacct allows me to do that.”

With automation replacing manual data entry and Excel work, overall accounting efficiency is up about 75%. Quicksilver has cut its monthly close time by 50%, from 28 to 14 days, and eliminated a week’s worth of laborious credit card and bank reconciliations.

“I can easily see the shifting of money between our checking accounts and reconcile it down to the dollar,” Rogness said. “That’s not just a time savings — it also increases visibility and accuracy.”

Quicksilver is also saving two to three days of manual payroll work each biweekly period with integration between Sage Intacct and Paycom payroll system, and spends 10 hours less a month on intercompany transactions.

Profitability Rises from 5% to 25%

Timely financials and new business insights are now delivering quantifiable benefits and helping shape Quicksilver’s business strategy. “We’re able to view our financials not on a 30-day look-back, but more on a day-to-day basis,” Rogness said. “The dimensional reporting has been great, as we can better track our expenses, our revenue, and easily pull reports for management.”

Slice-and-dice reporting allowed Quicksilver to spot vehicle insurance overpayments, while reporting insights also helped Quicksilver trim excess worker’s compensation insurance costs by ensuring that correct codes were applied to each employee. That netted annual savings of $100,000 in insurance costs.

“Through the visibility we’ve gained through Sage Intacct, we’ve been able to save substantially in the last year in vehicle and worker’s comp insurance,” Rogness said. “We’re very excited to have implemented a system in Sage Intacct that’s paid off 10-fold for us.”

Those and other insights contributed to an increase in profitability for Quicksilver, from about 5% at each location to as much as 25%. “For me as CFO and for our team, that’s been really exciting to see,” Rogness said.

Sage Intacct dashboards have also elevated visibility for Quicksilver leaders. For example, the president and general managers have key metrics and reports available on dashboards at any time. “Our president can pull a report herself, so that saves time for me and saves her the frustration of having to ask me for a report,” Rogness said.

Agility for COVID Adaptation and Business Growth

During COVID-19, Rogness has been able to focus on business adaptation and continuity. “COVID brought a lot of challenges, but we didn’t have to worry about our accounting system because Sage Intacct is in the cloud and we could work remotely,” said Rogness, who is based in Montana. “We could focus our efforts on how we could help our operations and driving staff, and deal with COVID regulations and opportunities like PPP loans.”

Going forward, Rogness is confident that Sage Intacct will grow with the company and support potential expansion into additional Midwestern states such as Texas and Nebraska.

“A major driver for moving off Microsoft Dynamics GP was our goal to expand,” Rogness said. “I’m confident that with Sage Intacct and other cloud-based systems, we’re going to be able to go into new locations without a huge initial investment or having to hire additional accounting staff.”

At the end of the day, Rogness enjoys the additional family time she has as a wife and mother of three since the move to Sage Intacct. “On a personal level, I’m able to have the flexibility that I desired when I had the dream of being CFO and also being a mother,” she said. “I’m able to have weekends off and take my kids skiing and camping. For me, that is a huge thing.”

See our customer success story to learn more about how Quicksilver Express Courier is thriving with its upgrade to Sage Intacct.

Case Study - Quicksilver Express Courier

Delivery firm boosts profitability with breakthrough insights and efficiencies gained in Sage software

Ask the author a question or share your advice