Navigating regulatory compliance on the road to IPO

Ensure seamless regulatory compliance on your path to IPO. Explore our blog for insights on navigating the SaaS regulatory landscape.

For SaaS companies, navigating regulatory compliance can be a DAUNTING task. And compliance only grows more challenging as you scale and inch closer to an IPO. For any SaaS company, but especially if you’re IPO-bound, non-compliance is a non-starter.

In this blog post, we’ll be 1) Diving into the importance of compliance and addressing SaaS-specific compliance challenges, 2) Discussing the negative impact of non-compliance on your operations and IPO suitability, and 3) Sharing strategies for proactively mitigating your compliance risk. Let’s get started.

Understanding SaaS compliance

SaaS companies are required to follow a variety of regulations that govern how they do business. Maintaining regulatory compliance encompasses following various laws applying to a range of business areas.

Some major examples of SaaS regulations include:

- SOX: The Sarbanes-Oxley Act is a U.S. law to protect investors by preventing fraudulent accounting and financial practices at publicly traded companies

- ASC 606: Accounting Standards and Codification 606 spells out specific guidelines for recognizing revenue and handling customer contracts.

- GDPR: The General Data Protection Regulation sets standards for protecting customers’ personal data in the European Union and the European Economic Area.

- HIPAA: The Health Insurance Portability and Accountability Act of 1996 sets strict rules for protecting health patients’ personal information.

- SOC 2: System and Organization Controls mandates certain cyber security best practices, which are increasingly necessary to combat the rise of enterprise hacking.

Clearly, that’s a lot to navigate. For SaaS companies, these regulatory mandates introduce what’s known as compliance risk.

Defining compliance risk

Compliance risk encompasses the potential for financial loss, legal issues, or reputational damage to a company resulting from regulatory non-compliance.

SaaS companies face compliance risks related to revenue recognition slip-ups, data leaks, lax internal security, and more, making it crucial for finance teams to understand and address these risks.

Let’s review a few compliance risks that are unique to subscription SaaS companies.

3 SaaS-specific compliance risks

SaaS companies encounter unique compliance risks that pertain to revenue recognition and data privacy laws.

As you scale and your IPO draws closer, these issues will only become more important–and more unmanageable, if you stick with legacy workflows.

These compliance risks include:

- Revenue leakage from poor ASC 606 management: Since you can’t officially report revenue that falls outside the scope of ASC 606, poorly managing this aspect of compliance can seriously impact your cash flow. For SaaS CFOs, ASC 606 presents the dual risk of revenue leakage and non-compliance fines.

- The potential for mishandling customer data: Many SaaS companies store massive quantities of customer data, ranging from personal to financial and possibly even medical information. This makes it a legal and ethical necessity to put reliable data storage and management systems in place.

- Losing investor trust over compliance issues: If your SaaS company can’t keep itself accountable and responsible with respect to compliance, you’d better believe your investors will notice. And they most likely will not be happy. Compliance mistakes–whether from revenue recognition, data management, cyber security, or something else–could weaken your credibility with investors, jeopardize future funding rounds, and even put your IPO at risk.

Now that you know more about SaaS-specific compliance risks, we’ll take a step back and answer a few fundamental questions.

Why are these regulations so important in the first place? How can you make compliance a company-wide value? And what are the risks of non-compliance beyond what we’ve already addressed?

The importance of regulatory compliance in SaaS

Let’s briefly review three SaaS compliance categories and explore why regulators needed to introduce the operative regulations for each one.

If you’re planning to go public, it’s especially valuable to understand why you’re making the effort to stay compliant, rather than relying on blind obedience. On one level, yes, the point of compliance is to avoid regulatory fines.

But there are deeper reasons behind these mandates.

1. Revenue recognition standards and regulations

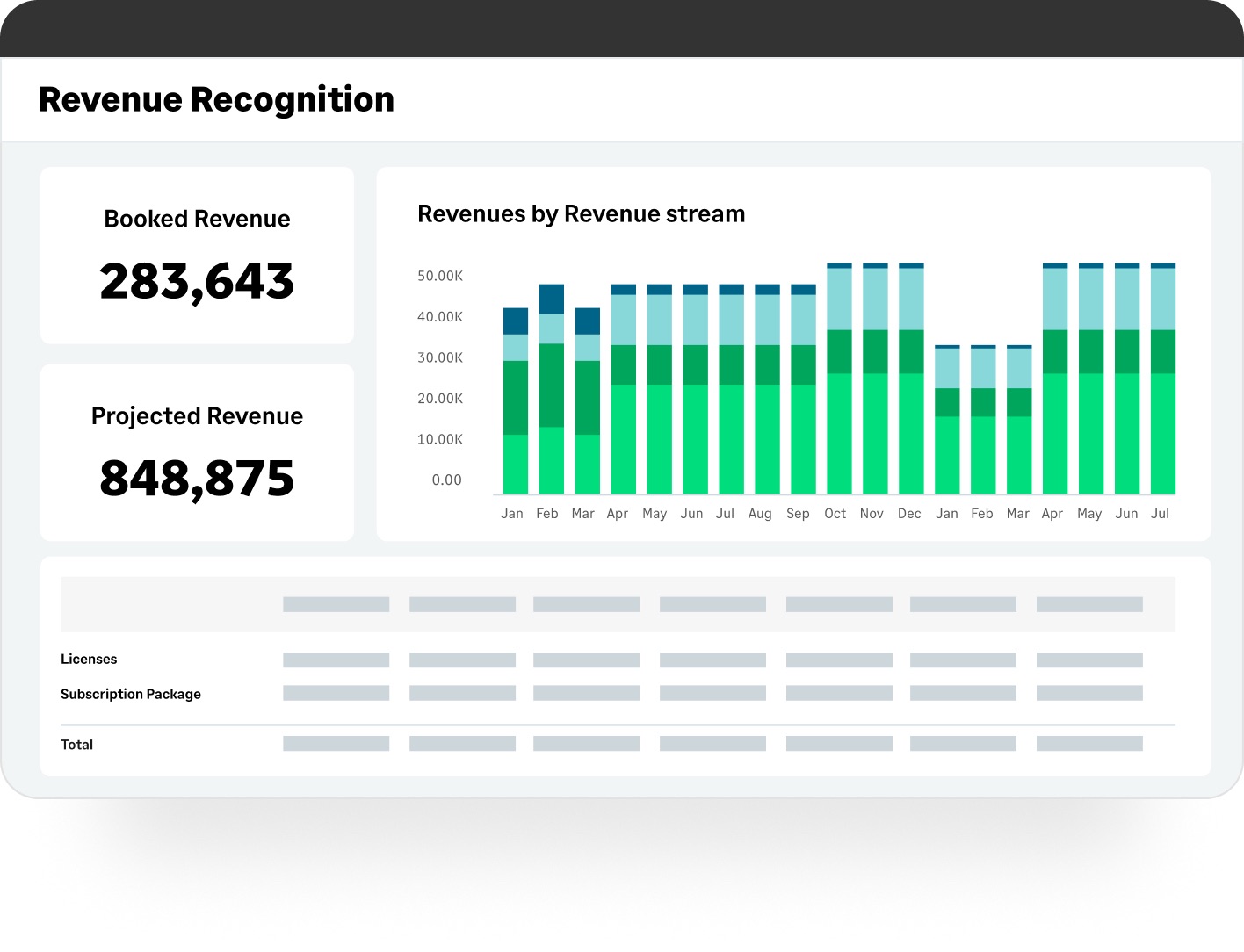

Revenue recognition standards provide a level playing field for recurring revenue businesses. If you booked $25,000 of annual subscriptions last month, and your accounting was done in a way that recognized that $25K of annual bookings all in that single month, you’d look much more profitable than you are.

ASC 606 and IFRS 15 keep companies from inflating their profits, enabling fair competition between organizations and financial transparency for investors.

Cloud accounting tools can help SaaS companies stay compliant while meticulously tracking deferred revenue.

2. Customer data protection laws

To understand this compliance category’s purpose, you have to put yourself in your users’ shoes. After all, you probably use a SaaS product or two yourself.

Whether it’s your banking information, healthcare data, phone number, SSN, or anything else, would you want your personal info floating in the digital breeze?

Customers trust you to handle their data responsibly, and regulations like GDPR and HIPAA ensure that companies behave ethically.

3. Cyber security regulations and mandates

This category is related to but different from data protection laws. Those regulations govern the use of customer data and things like mandatory disclosures–for instance, the requirement to inform customers about how their data is used.

Cyber security regulations are also largely founded on the importance of customer data, but they deal with your obligations to safeguard it, as opposed to what you can and can’t do with it.

SOC 2 and other cyber security regulations ensure companies can keep their data safe from internal and external threats.

Let’s review some strategies you can put in place to help you maintain unbroken compliance with these regulations.

Compliance risk management strategies

In order to uphold your compliance obligations and avoid unwanted scrutiny from federal agencies pre-IPO, you should establish departmental best practices.

Below are some ideas for SaaS CFOs.

Automating compliance

SaaS CFOs are increasingly turning to AI to help them navigate the growing demands of industry regulations. Take ASC 606 and IFRS 15, for instance.

Automating and centralizing revenue recognition with SaaS accounting software will allow you to:

- Permanently end revenue leakage.

- Receive automatic updates on regulatory changes.

- Know that protocols are being followed day in and day out.

- Avoid hefty non-compliance fines.

What else can you do to ensure that you maintain unbroken compliance?

Regular compliance audits and assessments

In adherence to regulatory standards, SaaS companies must conduct regular auditing to identify and mitigate compliance risks. This practice allows you to address any weak links in your compliance chain before they snap off and cause more serious problems for you or your customers.

Accounting software equipped with AI can dramatically decrease the time, cost, and hassle of the auditing process. When you’re approaching an IPO, your time and attention are at a premium. Don’t let them go to waste on manual auditing.

How else can automation assist SaaS companies with regulatory compliance management?

Addressing compliance challenges with automation

Regulatory compliance is essential to maintaining normal business operations, a prerequisite to further success.

When you factor that in with the prospect of regulatory fines, you see that how much money your company makes is directly tied to how it handles compliance.

Keeping that in mind, let’s examine how AI can help SaaS businesses solve two common regulatory headaches.

Varying regulations across geographies

It’s especially common for public SaaS companies to operate internationally. And of course, when you do international business, you need to comply with various global regulations.

Handling this manually increases the likelihood of mistakes that will expose your company to serious legal and financial repercussions.

Cloud accounting software can enable you to stay aligned with regulatory standards all around the world. AI lets SaaS finance leaders offload the stress of compliance to focus on more profitable tasks.

Adapting to evolving compliance standards

One of the biggest problems SaaS companies face around compliance is simply keeping up. Applicable laws can change on short notice, and if you aren’t paying attention, you could be left scrambling or even dealing with noncompliance fines.

The closer you get to an IPO, the more unprofessional compliance mistakes look. Accounting software equipped with AI automatically alerts you whenever a regulatory change impacts your industry.

Of course, you should still keep abreast of changing laws–new financial reporting standards, for instance–but having a bit of automated assistance can bring tremendous peace of mind.

Don’t let regulatory compliance get in the way of your IPO

An IPO is one of the most exciting moments you can have as a business leader. But for SaaS companies, there’s a whole tangle of regulatory red tape just waiting to ensnare you on the way there.

Compliance is an extremely serious issue–ethically, legally, and financially. And it’s complex. You have a lot more to worry about than just GAAP. If you’re not careful, regulatory fines can decrease your resources on the road to IPO, and compliance slips can damage your credibility with investors.

Automation can help you maintain unbroken compliance for your IPO journey. To learn more about the relationship between regulatory compliance and AI, check out our ebook: ASC 606 and Subscription Businesses.

ASC 606 and Subscription Businesses

Download the e-book now and equip yourself with the knowledge and strategies to navigate ASC 606 compliance for your subscription business.

Ask the author a question or share your advice