Kenect switches from a suite to Sage Intacct for easier, more robust financial reporting

The finance team at Kenect, provider of a SaaS-based business texting platform, was excited to use a suite-based accounting application for financial management, as the company rapidly expanded.

The finance team at Kenect, provider of a SaaS-based business texting platform, was excited to use a suite-based accounting application for financial management, as the company rapidly expanded.

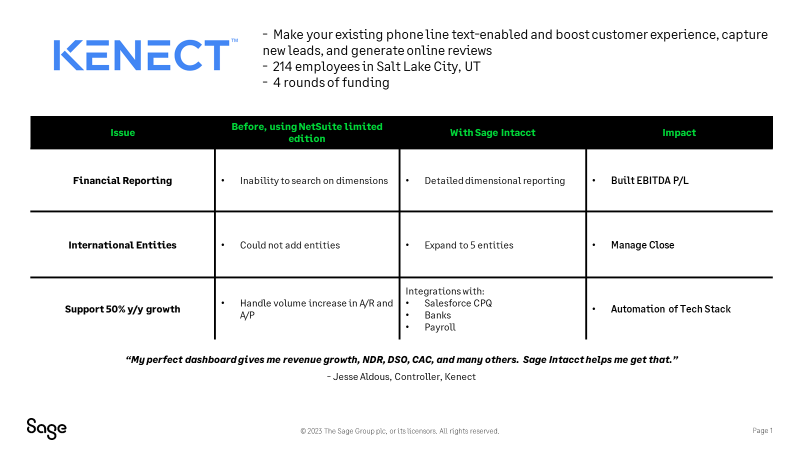

That excitement diminished once the team encountered multiple limitations.

“Complicated” reporting jeopardizes business decisions

Spending time manually wrestling with multi-entity consolidations didn’t sit well with the

5-entity company, who ranked on the Inc. 5000 in the last 2 years. With a 3-year revenue growth of 641% through 2022 and more than 200 employees, something needed to be done to simplify.

Financial reporting shortcomings of the software didn’t let Kenect generate the insightful reporting and metrics the Utah-based company needed to help guide growth.

“90% of what I do is identifying key stakeholders inside and outside the business and turning transactional data into information—the reporting that stakeholders need to make decisions on how to allocate resources and run the business,” says Jesse Aldous, Kenect’s Corporate Controller.

Sage Intacct “checked all the boxes”

Aldous was also concerned about his ability to scale given rapid growth at Kenect, whose innovative business-texting platform helps customers increase leads, generate online reviews, and boost engagement and revenue.

“My job is not only to meet the company’s current needs, but with the growth that’s happening, meet the needs of 1 or 2 years ahead—what will we need then?” Aldous says. “I can’t do that with the current setup.”

Revisiting its options, Kenect decided to make the switch to Sage Intacct. It joined other SaaS-based and software companies in realizing that while other options may be perceived as bigger, Sage Intacct is better.

In fact, Sage Intacct has surpassed other options to be the #1 solution of choice for software companies outgrowing QuickBooks or migrating from a legacy system, according to a study by The SaaS CFO.

“Sage Intacct just checked all the boxes,” Aldous says. “Its dynamic dimension groupings just blew open the door on the possibilities of providing financial reports to my management team, banks, and our private equity firm.”

Aldous adds, “The way Sage Intacct is structured, I can create at the push of a button a P&L or balance sheet for each of [our stakeholder groups] and simplify my life. That makes the reporting consistent, easy to use, and insightful.”

A unified tech stack to streamline finance

As it scales up, Kenect will be using Sage Intacct as the core of a unified tech stack, connecting the cloud-based financial management platform with best-of-breed applications to deliver automation and information across the business.

Utilizing Sage Intacct’s open API, integrations with Salesforce CRM, Revenue Cloud, and CPQ (configure, price, quote) modules stand to accelerate and streamline the quote-to-cash cycle.

Other integrations between Sage Intacct and systems for payroll, accounts payable automation, sales tax automation, and Kenect’s bank partners will help the company replace labor-intensive manual work with breakthrough efficiency.

“It’s going to streamline the month-end process and makes for 1 less step for error as we move from a manual to automated process,” Aldous says.

And unlike his scalability concerns with their previous platform, Aldous is confident that Sage Intacct will easily scale along with Kenect’s continued growth in revenue, customers, and geographies.

“We could use Sage Intacct well beyond $100 or $200 million in revenue,” Aldous says.

Learn More

Find out more about how Sage Intacct can help your tech company achieve its goals with efficient, insightful financial management: