Financial planning and analysis (FP&A) strategies for SaaS CFOs during a recession

Amidst a recession, FP&A (financial planning and analysis) matters now more than ever for SaaS CFOs. We’ve got you covered.

For SaaS CFOs, one set of letters eclipses almost all others in importance: FP&A. Financial planning and analysis is the bread and butter of any successful SaaS company. It’s vital at all times, but it becomes even more so during a market correction like the one we’re currently experiencing.

Any great CFO needs to have visionary qualities, a strong sense of imagination, and intuition for strategizing. But that side also needs to be balanced by a completely objective one. You need to be able to look around you at what isn’t working and eliminate it or optimize it. That’s the heart and soul of FP&A, after all.

Here are some of the best capital preservation strategies for SaaS CFOs when the company’s belt needs to be tightened a notch or two.

FP&A to support marketing: Take an honest assessment

It’s a truism in business that you often have to spend money to make money. That’s more or less always the idea behind marketing expenditures. But sometimes, even our best-intentioned efforts aren’t yielding the results we initially hoped for.

At times like these, CFOs encounter a choice: persevere in what isn’t working and hope for some miraculous change, or pivot to something else. It can be hard to make those decisions, but being an effective leader means doing everything you can to move the company forward.

When it comes time to analyze your marketing expenditures vs. their effectiveness, two of the “top suspects” include:

- Sales & marketing staff: It’s always hard letting people go, but sometimes companies are overstaffed in certain areas relative to departmental performance. Being objective about those situations is an essential aspect of business leadership.

- Fruitless digital marketing: Consider convening with your company’s CMO to get their direct and honest thoughts about the effectiveness of recent digital marketing efforts. Two minds are often better than one, and the CMO should be well-equipped to advise your decision-making.

Taking a good, hard look at your marketing is a strong start for your SaaS FP&A efforts. But it should just be the beginning.

Drop unprofitable service offerings

This second tactic is similar to the previous one. Except, instead of analyzing your sales and marketing liabilities, you’re putting your service offerings and customer demographics under the microscope.

For SaaS companies, your content is your service offerings. In other words, if your products and services aren’t cutting it for people, no amount of marketing will help you in the end.

A few reliable signs that you should cut your losses on a given project or product include:

- Rollout has taken at least 25% longer than planned: If a product rollout has occupied considerably more time than you anticipated, it might be time to pull the plug. A certain amount of intuition is required on this one: sometimes, there are genuinely good reasons a rollout gets delayed. But it might also be time to reconsider the broader project.

- The reception was lukewarm and isn’t heating up: Not every idea will be wildly successful. If it’s been a while since your product hit the market and it isn’t gaining traction, sometimes walking away and focusing on something else is the right choice.

- There’s a heavy opportunity cost: The numbers don’t lie. Sometimes it’s clear as day that continuing to throw money at a floundering project, or even a decently performing one, keeps a clear winner from climbing even higher.

Remember to stay as objective as you can about projects and products. That can be difficult, especially if you or your team had a special role in a particular endeavor. But at the end of the day, the company’s long-term success has to come first.

Scale (faster and less expensively) through automation

The most successful SaaS CFOs know that automation is the golden ticket to accomplishing more while cutting costs. During a recession, what more could you possibly want?

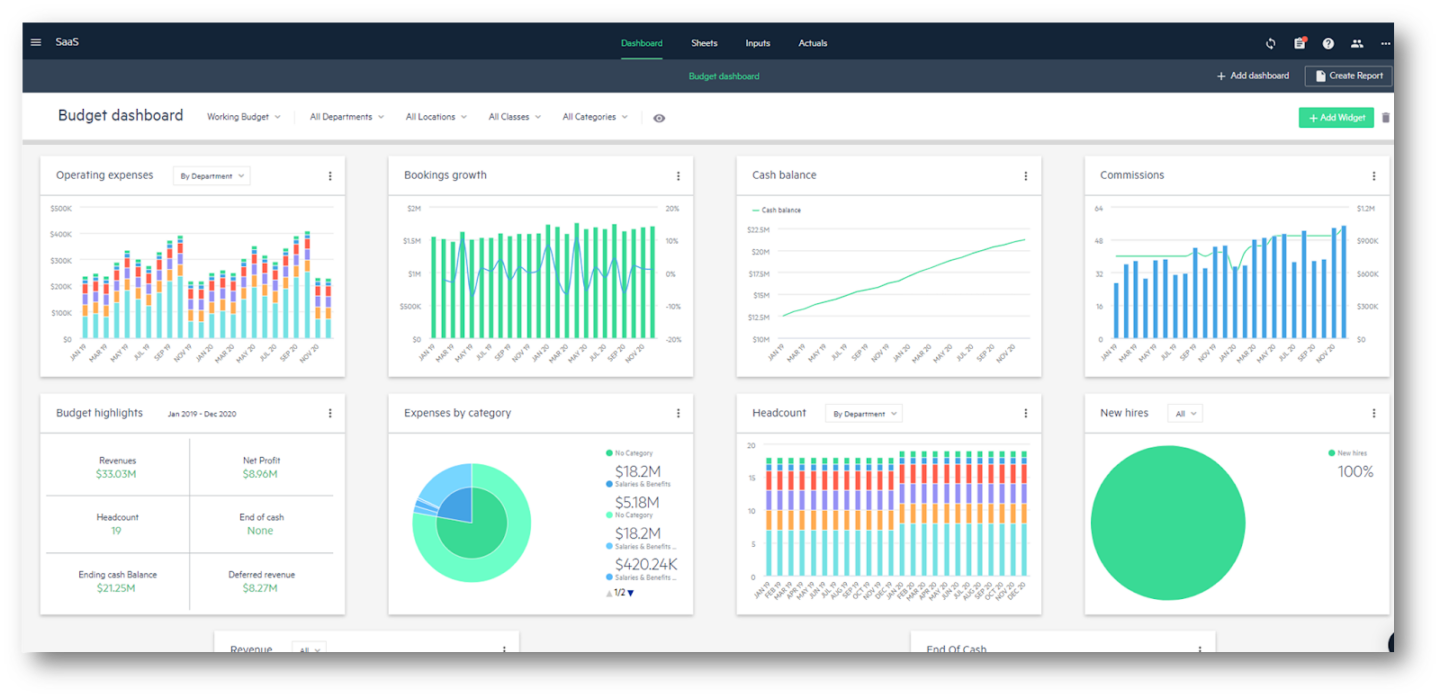

Cloud-based budgeting and planning accounting software from Sage Intacct will jumpstart your team with:

- Continuous closing: The monthly close cycle can be a severe headache for accounting teams. With continuous closing, your books are automatically closed on a transaction-by-transaction basis.

- Sophisticated forecasting: Accurately forecast your customer lifetime value, churn rates, cash burn rate, and other vital metrics. Plug in different scenarios and parameters to create all kinds of “if-then” flexibility in your planning and decision-making.

- Role-based dashboards: As the CFO, you have different objectives than the Controller, who has distinct objectives from others on your team. Role-based dashboards let you see all the data you need with a single glance.

Our accounting software can even help you master ASC 606 and more. (For a more detailed overview, see: 5 Steps to Recognizing Revenue Under ASC 606.)

SaaS FP&A for the 21st century

Market corrections and recessions are just a financial fact of life. No country is immune, and no industries or markets are immune, not even SaaS.

Rather than hoping it never rains, be proactive and buy an umbrella (or five…a real storm’s brewing). Or better yet, use your SaaS metrics to carry you successfully through the recession. Check out our ebook to learn more.

Ask the author a question or share your advice