Cloud-native Financial Management: Guide for SaaS Companies

For SaaS finance teams, automating billing, cash-flow, and forecasting is the difference maker in finding product/market fit and winning your market. It enables teams to eliminate manual workflows, bill their clients seamlessly, synchronize revenue recognition, and more.

But as it turns out, it’s not a simple matter of just moving to the cloud and continuing business as usual. There’s another question to consider. Even if you already operate in the cloud, are you practicing cloud-native financial management?

This digital guide for SaaS companies will walk you through the essentials of cloud-native financial management. What is it, and how can it help your accounting department operate more effectively?

The Limitations of “Lift and Shift” for SaaS

The widespread use of cloud applications has given rise to what’s known as “lift and shift” functionality.

When a team lifts and shifts its data, it moves a copy of an app or workflow from a non-cloud location into cloud storage. In theory, the team should then be able to continue business as usual in the cloud.

In reality, however, the lift and shift approach comes with some inherent risks:

- Application bugs will carry over from the original hosting location to the cloud.

- The migration process exposes teams and their data to risks from hackers and other cyber vulnerabilities.

- Intricate and time-consuming application mapping is required to execute a successful migration.

Let’s see how cloud-native financial management differs from this method.

What is cloud-native financial management?

Unlike the lift and shift method, cloud-native financial management uses software explicitly built for the cloud.

This provides teams with a more streamlined and reliable experience from the start and removes the hassle of data migration. Cloud-native financial management allows SaaS CFOs to:

- Eliminate revenue leakage by syncing datasets

- Create a truly collaborate environment

- Improve ARR and MRR

Let’s go through some of the most common problems that arise from the lift and shift approach. After that, we’ll go into much more detail about the specifics of cloud-native financial management.

Risks of Settling for Cloud-Enabled Solutions

If you allow cloud-enabled solutions to become the norm in your organization, you stand a good chance of running into workflow difficulties.

Some of the key themes you can expect include:

- A higher risk of manual errors, generally speaking.

- Difficulty creating an integrated financial environment.

- Time and capital expenditures that would’ve been better used elsewhere.

What are the specific attributes of cloud-enabled solutions that make this the case?

Lack of Third-Party Connectivity

SaaS organizations often rely on third-party applications to help them execute various business processes.

Cloud-enabled apps are sometimes a hassle in and of themselves, and they often can’t manage third-party functionality even if you carry out a successful migration.

It’s often just too much for cloud-enabled applications to handle, at least without considerable strain that can detract from other processes.

Lack of Precision Around Workflow Alterations

SaaS finance leaders need to be able to adjust their workflows and processes with scalpel-like precision. And they should be able to do so at a moment’s notice, with practically no manual effort.

Cloud-native financial management gives leaders this ability. This is not the case with cloud-enabled apps.

If you wanted to make a billing adjustment, for example, you would be required to go back and adjust an entire chain of embedded commands to alter that single workflow.

As you can imagine, this can turn theoretically simple tweaks into costly and time-intensive endeavors.

Leaves Vulnerabilities for Hackers

As we mentioned earlier, the migration process necessitated by cloud-enabled solutions is a potential gateway for hackers.

However, we didn’t mention how severe penalties can be for a SaaS data leak. Your company could be fined tens of thousands of dollars–some firms have been hit for millions–in the event of a breach.

Depending on the type of data breach, your firm might be required by law to contact every person affected and tell them about the situation. You may even need to compensate them if the case is severe enough.

Cloud-native financial management largely bypasses these concerns, giving SaaS finance leaders valuable peace of mind. Security isn’t the only benefit of cloud-native financial management, though.

The benefits of cloud-native financial management for SaaS companies

Most of the time, when SaaS companies decide to switch to cloud-native software, they’re seeking three competitive advantages:

1. Scalability: Cloud-based financial management systems enable SaaS CFOs to scale their companies more rapidly and sustainably, while sidestepping many of the traditional SaaS growing pains.

2. Flexibility: Cloud-based systems can be accessed from anywhere and from any device, making it easier to work remotely and collaborate with team members.

3. Cost savings: Cloud-based financial management solutions can reduce the costs associated with maintaining hardware and software, and limit the need for dedicated IT staff.

What specific day-to-day benefits does your department stand to gain from a cloud-native approach? And how will they help you meet these goals?

Enhanced Regulatory Agility

Recurring revenue companies are beholden to stringent accounting regulations–ASC 606, IFRS 15, SOX, and others.

Cloud-native financial management software provides real-time regulatory updates and notifications, so you’re never at risk of slipping up.

Offers the Smoothest Possible Customer Experience

Cloud-enabled solutions can raise involuntary churn from missed payments that were the application’s fault, and cause other issues for your customers.

Additionally, many SaaS users prefer various types of subscription, usage, or hybrid billing. Cloud-enabled solutions often lack the bandwidth to support this. Or, if they can, their results are not always dependable.

Helps CFOs Adjust to Any Market Conditions

As the current downturn has taught many SaaS CFOs, agility pays.

CFOs who deploy cloud-native financial management can use automation to gain strategic clarity in turbulent times.

Cloud solutions allow SaaS CFOs to turn on a dime, adjusting their strategies and campaigns at a moment’s notice.

RELATED: Financial planning and analysis (FP&A) strategies for SaaS CFOs during a recession

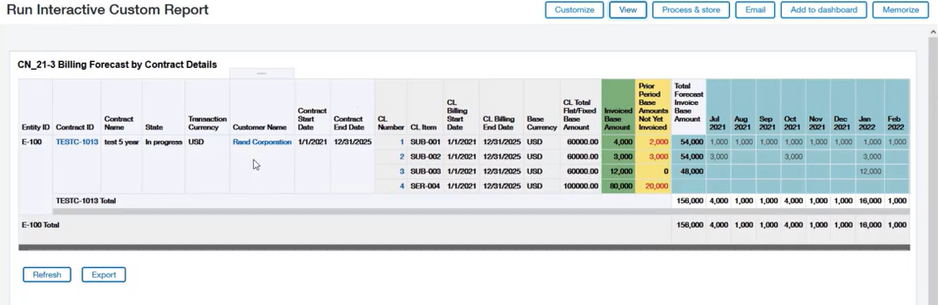

Provides Streamlined Reporting & Forecasting

Reporting and forecasting are essential tasks for any SaaS CFO. If you lack the means to forecast and report effectively, you’ll have a harder time scaling, attracting investment capital, and maintaining profitability.

Cloud-native financial management gives CFOs access to fully automated financial reporting and forecasting.

Embrace Cloud-Native Financial Management

Companies who take the leap into cloud-native financial management quickly realize what they were missing out on before.

The cloud is the secret ingredient that turns the hectic and messy world of recurring revenue into a profitable, orderly, manageable enterprise.

Key features of cloud-native financial management systems

A few more benefits of cloud-native financial management include:

- Integration with other business systems: Cloud-native software can leverage APIs to easily integrate with your other business applications–your CRM, project management software, billing software, and more.

- Customizable reporting: This help SaaS companies gain insights into their financial performance and make data-driven decisions.

- Automated billing and invoicing: Billing and invoicing are two of the most error-prone, expensive, and time-consuming processes for any software organization. Switching to the cloud will save considerable time and cut manual errors by 100%.

Cloud-native financial management is allowing SaaS accounting teams to operate more effectively, accurately, and cohesively.

How Sage Intacct can streamline your business

Sage Intacct leverages cloud-based financial management to help SaaS CFOs understand cash coming in and cash going out at a granular level.

In addition to cloud-based financial management, we’ve recently discussed a full range of recession management strategies for SaaS finance leaders. You can find them in our recent ebook for SaaS CFOs.

Managing modern finance (reference only)

Discover how taking the right steps to modernise accounting management systems will help your business gain insights that will lead to improved productivity and reduced costs, and prepare you for rapid growth.

Ask the author a question or share your advice