Cloud-enabled vs. cloud-native financial planning software: What’s the distinction?

Choosing the right platform can make a huge difference in both your day-to-day workflow and long-term business goals.

Your financial planning software just crashed—again. In the middle of a crucial budget review.

You know that you need to move to the cloud, but as soon as you make that decision, you’re faced with another: cloud-native or cloud-enabled?

They might sound similar, but there are some essential differences that SaaS CFOs need to consider before making a purchase.

Let’s compare both types of tech so you can make the most informed decision for your business.

Here’s what we’ll cover

- The rise of cloud financial management

- Cloud-enabled vs cloud-native: understanding the key differences

- The impact of cloud-native solutions on financial planning

- Challenges and considerations in adopting cloud financial planning software

- Choosing the right cloud financial planning solution for your organization

- Cloud-enabled or cloud-native: Which will you choose?

- Resources

The rise of cloud financial management

According to Foundry’s 2023 Digital Business study, 93% of organizations have adopted or plan to adopt a digital-first business strategy.

And it’s no wonder: over the years, cloud financial management has completely changed how businesses handle their financial processes—offering unprecedented flexibility, scalability, and efficiency that traditional methods simply can’t match.

As the adoption of digital-first approaches to business processes, operations, and customer engagement has grown, so has the need for robust cloud financial management solutions.

The shift to cloud-based financial management is driven by several factors:

- Real-time access to financial data

- Support for remote work

- More efficient and automated financial processes

- The need for scalable solutions as businesses grow

93% of organizations have adopted or plan to adopt a digital-first business strategy

Cloud-enabled vs cloud-native: understanding the key differences

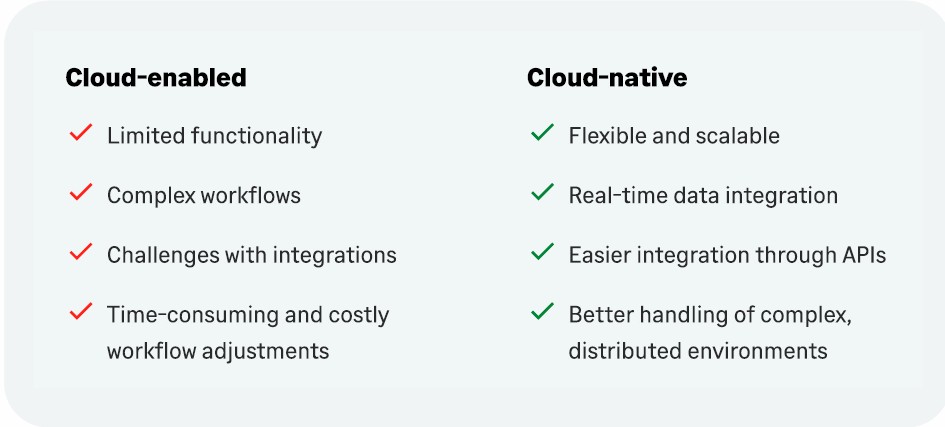

While both cloud-enabled and cloud-native solutions offer benefits over traditional on-premises software, they differ significantly in their architecture and capabilities.

Let’s break it down:

Cloud-enabled software is a start, but…

Cloud-enabled SaaS budgeting refers to a traditional budgeting solution re-hosted in the cloud.

This is also described as a “lift and shift” application.

Although it sounds innovative, it’s more of a jerry-rigged approach than a true innovation—like upgrading your trusty (and rusty) bicycle with an electric motor.

While it’s a step up from purely on-premises solutions, it comes with limitations:

- Limited functionality compared to on-premises versions

- Potential struggles with complex, automated workflows

- Challenges in integrating with third-party applications

- Time-consuming and costly workflow adjustments

Cloud-native accounting software was born and bred for this

On the other hand, cloud-native SaaS budgeting solutions are specifically designed for cloud use.

They offer much more flexibility, scalability, and real-time data integration.

And unlike cloud-enabled options, you’ll never get halfway through a forecast model and suddenly have the whole thing short out on you.

Cloud-native software offers:

- Enhanced flexibility and scalability

- Seamless real-time data integration

- Better handling of complex, distributed environments

- Easier integration with other business systems through APIs

Cloud-native applications are built to take full advantage of cloud technology, offering a more robust and future-proof option for businesses looking to optimize their financial planning processes.

The impact of cloud-native solutions on financial planning

Cloud-native financial planning solutions offer significant advantages that can have a pretty big impact on how businesses handle their finances.

One of the most important benefits is real-time financial visibility.

With could-native software, CFOs and their finance teams have access to up-to-the-minute financial data, allowing them to make informed decisions based on the most current information.

Another key advantage is automation.

Time-consuming tasks like invoicing, expense tracking, and financial reporting can be automated instead of keeping your team up all night.

This not only makes everyone happier but reduces the risk of human error—because tallying up expenses at 1am with the aid of an energy drink is never a good idea.

For teams that work remotely, which is now commonplace, cloud-native options greatly enhance collaboration, leading to better communication and more efficient workflows.

Finally, scalability is a huge advantage of cloud-native financial planning.

As businesses grow, these solutions can easily scale to accommodate increased data volume and more complex financial processes without requiring an infrastructure overhaul.

So if you want financial planning software that grows with your business, without having to learn (and train on) something new every year, cloud-native is an investment with long-term value.

Challenges and considerations in adopting cloud financial planning software

Hopefully, the benefits of choosing could-native financial management options are clear, but implementing any new system of course has challenges.

Data migration

Data migration is often one of the biggest hurdles to overcome.

Transferring historical data to the new system can be so complex and time consuming that you’d rather not even start.

But if you have a solid data-migration strategy in place, you can make sure that no critical information is lost in the transition.

User adoption

Similarly, user adoption can be a challenge, as employees may resist new workflows or interfaces.

Providing comprehensive training and highlighting the benefits can help smooth this transition.

System integration, security, and compliance

Ensuring smooth integration with existing business applications and compliance requirements is key.

Cloud-native solutions typically offer better capabilities in both areas, so it’s an important factor to consider during selection.

Choosing the right cloud financial planning solution for your organization

Landing on the ideal cloud financial planning software requires careful consideration of your business needs and goals.

Here are some factors to keep in mind:

- Assess your needs: Consider your current and future financial management requirements, including the complexity of your processes and growth projections.

- Scalability: Make sure the solution can grow with your business. Cloud-native solutions typically offer better scalability but verify this with potential vendors.

- Integration capabilities: Look for software that easily connects with your existing business systems to create a cohesive financial ecosystem.

- User experience: Choose software with an intuitive interface to promote user adoption across your organization.

- Total cost of ownership: Consider long-term costs, including maintenance, upgrades, and potential customization needs—not just the initial price tag.

Cloud-enabled or cloud-native: Which will you choose?

By now, you likely know our opinion on this.

While cloud-enabled solutions offer some benefits, cloud-native solutions are better equipped to handle the complex needs of modern businesses, offering superior performance, integration capabilities, and future-readiness.

But hey, we get it—our team works closely with CFOs around the world and we understand your challenges.

Choosing new software and migrating your financial systems is a big deal. The right cloud financial planning software isn’t just a tool—it’s a strategic asset that offers some pretty exciting possibilities for the future.

So carefully go through the checklist above. And when you’re ready to explore cloud-native financial planning software, Sage has the cloud-native solutions that can scale with you as your business evolves.

Sage can help you transition seamlessly to cloud-native financial management.

Resources

- https://www.sage.com/en-us/blog/cloud-native-financial-management-guide-for-saas-companies/

- https://www.sage.com/en-us/blog/using-on-premises-software-why-move-to-the-cloud/

- https://www.sage.com/en-us/blog/unlock-your-agility-with-cloud-native-applications/

- https://www.sage.com/en-us/blog/business-growth-challenges/

- https://www.sage.com/en-us/blog/cloud-accounting-software-expert-tips-for-success/

Ask the author a question or share your advice