Cloud accounting software: expert tips for success

Discover expert tips for success with cloud accounting software. Simplify your financial management with our insightful blog.

In this blog, we’ll dive deep into the world of cloud accounting software and provide you with expert tips for successfully implementing it.

From understanding the key features and benefits of cloud accounting software to choosing the right one for your SaaS business and mitigating common challenges, we’ve got you covered.

We’ll also explore how cloud accounting software can impact the success of your SaaS company by enhancing decision-making, boosting customer retention, and using SaaS metrics to simplify acquiring new customers.

If you’re ready to revolutionize your accounting processes and keep your company moving in the right direction, this post is for you.

Here’s what we’ll cover

- Understanding cloud accounting software: setting the stage

- Benefits of adopting cloud-based planning software for SaaS companies

- Choosing the right cloud accounting software for your SaaS business

- Implementation of Cloud Accounting Software in SaaS Companies

- Some common challenges in cloud accounting software adoption: data security, compliance, and resistance to change

- How else does cloud accounting software impact the profitability of a SaaS company?

- Give your software organization the gift of cloud accounting (in 9 easy steps)

Understanding cloud accounting software: setting the stage

Automated cloud accounting software is a powerful tool that helps businesses streamline their financial processes, improve organization-wide visibility, and enhance efficiency on a daily basis.

By understanding cloud accounting software and how it works, you can make informed decisions for your business that help build your customer base.

One of the key benefits of using cloud accounting software is gaining real-time access to every important metric you need, from customer lifetime value (LTV) to annual recurring revenue (ARR) and more.

From SaaS metrics to deferred revenue waterfalls, you’ll have an accurate picture of your cash flow that’s always up to date.

Additionally, cloud accounting software offers automatic backups, ensuring the security of your financial information.

Key features of cloud accounting software

One of the main advantages of cloud accounting is that it provides real-time access to your financial data from anywhere, on any device, at any time.

This is extremely important in light of the prevalence of remote and hybrid roles at software companies.

Additionally, cloud-based automation allows accounting leaders and finance teams to stay informed about their metrics on a day-to-day and moment-to-moment basis.

Touchless invoicing and automatic payment reminders streamline the SaaS billing process, ensuring you get paid on time.

Other benefits of cloud-based tools include:

- Integration of bank feeds to automate the syncing of bank transactions, eliminating the need for manual data entry.

- Advanced reporting features enable businesses to track their performance and make informed decisions, even in a recession.

- Data security measures, such as encryption and regular backups, ensure the safety of financial information.

With these key features, cloud accounting software is valuable for businesses looking to streamline their financial processes and stay on top of their cash flow.

Benefits of adopting cloud-based planning software for SaaS companies

Cloud-based planning software offers numerous benefits for SaaS companies. One advantage is scalability.

Cloud-based software can easily scale up or down to accommodate the growth of a SaaS company.

Additionally, cloud software is cost-effective as it eliminates the need for expensive hardware and IT infrastructure.

Data security is also a crucial benefit, as cloud-based software typically offers robust security measures and regular backups to protect your data and your customers’ financial information.

Lastly, integration is seamless with cloud accounting software, enabling easy integration with other business tools and applications, streamlining workflows, and increasing efficiency for SaaS companies.

Why else is cloud accounting far more effective and efficient than legacy manual processes?

Cost efficiency

SaaS companies can save on software licensing fees with a subscription-based cloud solution.

Additionally, cloud software eliminates the need for manual data entry, saving time and reducing administrative costs.

Furthermore, cloud-based solutions provide real-time visibility into financial data, enabling better decision-making and cost control.

By leveraging these cost-efficient features, SaaS companies can optimize their operations and allocate resources wisely.

With reduced expenses to manage and improved financial insights, finance leaders can focus on growth and long-term profitability.

Operational flexibility and more time to focus on what matters

The flexibility of cloud-based software enables SaaS companies to access their financial data from anywhere, at any time, promoting efficient navigation and collaboration among team members, regardless of their location.

By adopting cloud-based planning software, SaaS companies can quickly adapt to market changes and stay competitive in the long term.

Cloud accounting software frees up significant time by streamlining processes such as invoicing and payroll.

With more free time, you and your team can focus on other priorities like FP&A, improving the customer experience, and reducing churn.

Seamless Integration

Cloud-based planning software enables seamless integration with other SaaS tools, optimizing processes and enhancing the efficiency of your department.

By integrating your applications with cloud accounting software, you achieve real-time data syncing, ensuring financial planning and reporting accuracy.

Automating data transfers eliminates the need for manual entry, reducing the risk of errors and discrepancies.

Since cloud-based planning software integrates with various platforms, it provides more scalability and flexibility for growing SaaS companies. This seamless integration between cloud-based planning software and other business applications will improve your collaboration and decision-making across departments. By leveraging the power of seamless integration, SaaS companies can streamline their operations from top to bottom, improve productivity, and navigate their business journey successfully.

Choosing the right cloud accounting software for your SaaS business

Assessing your SaaS business’s needs and requirements is crucial when selecting cloud accounting software. Consider the following best practices for SaaS CFOs:

- Prioritize scalability and flexibility. The software should be able to scale up or down to accommodate your present needs seamlessly.

- Look for features such as automated invoicing, expense tracking, and comprehensive financial reporting to streamline your operations.

- Prioritize data security and backup options offered by the software to safeguard your confidential information.

- Research the customer support and training options available to ensure a smooth transition.

- Check for integration capabilities with other software and tools used in your business to enhance efficiency and productivity.

By carefully considering these factors, you can choose the right cloud accounting software that aligns with your SaaS business’s goals and objectives.

Determining your business needs

Consider the specific accounting features your department requires, such as automatic invoicing and expense tracking.

What financial processes are you currently struggling with? Have you been achieving your revenue goals?

If not, why?

Has real-time visibility been a factor?

Your team spent too much time backtracking to fix manual mistakes?

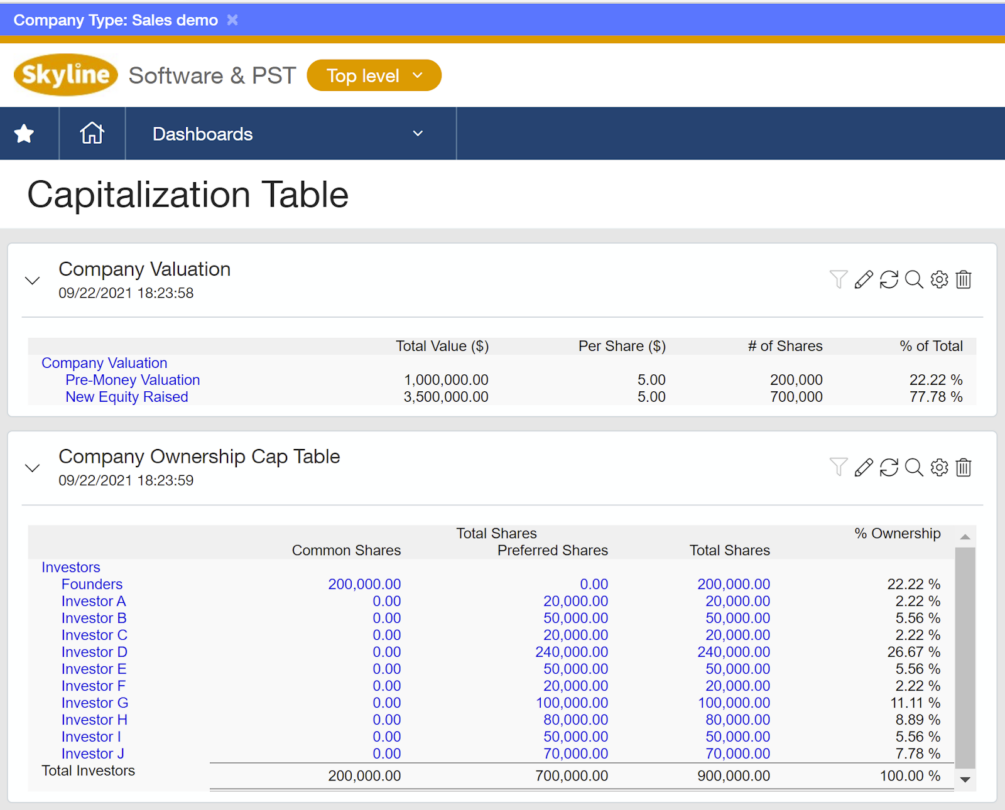

Your company lacked clarity around fundraising and capitalization, leading to business performance that fell below investor expectations?

Asking yourself these questions will help you select the best cloud accounting solution for your department.

Evaluating your options: the due diligence phase

When evaluating the market options for cloud accounting software, there are several factors you should consider.

Firstly, it’s important to evaluate the features and functionality of different software solutions through various product demos.

Look for software that offers the specific accounting features you need, such as automated invoicing, expense tracking, or role-based dashboards.

Integration capabilities are also crucial.

Look for software that seamlessly integrates with other tools and platforms you use in your business, such as your CRM or project management software.

Assessing the level of customer support and training each software provider offers is also essential.

Consider the available support channels, the quality of training materials provided, and whether the customer support team is accommodating and willing to work with your staff for as long as necessary to get you up and running.

With the assistance of a knowledgeable customer success liaison or team, a carefully phased and well-planned cloud accounting rollout is quick and simple.

Lastly, compare pricing plans and ensure the software aligns with your budget and financial goals.

Take into account the total cost of ownership, including any add-ons or extra fees.

If your provider uses a subscription model, look through their various subscription tiers and select the one that best matches your company’s needs.

By carefully evaluating the options on the market, you can choose the best cloud accounting software for your SaaS business’s unique circumstances.

Implementation of Cloud Accounting Software in SaaS Companies

Implementing cloud-based planning software is pretty straightforward, but there’s a caveat. It’s straightforward as long as you take the time to intelligently craft your rollout strategy upfront.

SaaS CFOs who frontload the hard work–and really, it’s not that hard–by planning an effective rollout are rewarded with a speedy and simple transition on the back end of the process.

You might think, “Didn’t you just say that my software provider will have a customer success agent help us take care of that?”

Yes, you’ll have external assistance–if you select a reputable vendor. But you still need to contribute to the process by doing some planning yourself.

For instance, by trying out a demo version beforehand, you’ll have specific and actionable questions for your customer success liaison rather than being a passive participant during the setup.

You’ll also have greater familiarity with the solution, simplifying and accelerating the training process and overall transition.

Plan and prepare for the implementation by setting goals, defining roles, and ensuring data migration and system integration go smoothly.

To ensure success, train and educate stakeholders and team members on how to effectively use the software, paying special attention to automated workflows such as:

- Touchless invoicing

- Expense tracking

- Managing payroll with AI

- Creating and altering advanced automated forecasts

- Getting comfortable with role-based dashboards

Remember that maintenance for cloud-based accounting solutions is nonexistent apart from the initial setup period.

After the initial implementation, regularly reviewing and updating your cloud accounting system will optimize performance and support long-term profitability.

By leveraging cloud accounting software, SaaS companies can easily navigate complex financial tasks and focus on delivering exceptional customer service and driving growth.

What else goes into a successful transition to cloud accounting?

Preparing your team

To ensure a smooth transition to cloud accounting software, taking the time to properly prepare your team is crucial.

This starts with helping them understand the value of automation and fostering a mindset that embraces its advantages.

Clearly communicate the benefits of using cloud accounting software to your department, emphasizing how it can streamline financial processes and improve day-to-day efficiency.

Beyond that, you need to identify key team members responsible for overseeing the implementation process and allocate resources for training and support during the transition period.

Develop a timeline to ensure that training is conducted effectively.

Encourage open communication and feedback from your team throughout the implementation process, as their input can help address any concerns or challenges that arise along the way.

Data Migration and System Integration

Data migration becomes a critical issue when implementing cloud accounting software in your department.

As a quick refresher, data migration involves transferring your existing data from old systems to your new cloud-based solution.

System integration is necessary to ensure smooth data flow between the cloud accounting software and other applications you use.

Integration allows for real-time data synchronization and eliminates manual data entry.

Careful planning and testing are essential to ensure accurate and complete data migration.

By working with experienced professionals, the data migration and system integration process can be significantly simplified.

Cloud software experts have the expertise to navigate potential challenges and ensure a seamless transition.

Implementing cloud accounting software with proper data migration and system integration capabilities can lead to improved efficiency, better financial insights, and a more streamlined business overall.

Some common challenges in cloud accounting software adoption: data security, compliance, and resistance to change

Some of the primary roadblocks to adopting this technology are data security, compliance, and employee resistance to change–and sometimes these pain points are related.

Employees who are resistant to adopting cloud-based accounting might bring up the security and compliance difficulties associated with large-scale data migrations to justify their position.

How should you respond if these points arise in your department or company?

Ensuring data security and uninterrupted ASC 606 compliance with centralized revenue recognition

When it comes to adopting cloud accounting software, data security and ASC 606 compliance are naturally top priorities for SaaS CFOs.

To protect sensitive financial information, it’s crucial to choose a software provider that offers robust encryption and data backup measures.

Additionally, prioritize vendors and solutions that offer robust yet flexible automated internal control architecture for security purposes.

Monitoring and auditing system activity regularly can help identify potential breaches or unauthorized access. Educating employees on best practices for data security and emphasizing the importance of keeping sensitive information safe is also essential.

Additionally, working with an experienced and reputable vendor will ensure no problems interrupt your ASC 606 compliance.

Even after the deployment, though, you should still develop a revenue recognition strategy if you haven’t already done so.

By following these measures, businesses can strengthen their data security, stay compliant and avoid revenue leakage while protecting their financial information.

Overcoming resistance to change (whether from employees, stakeholders, or anyone else)

Resistance to change is a natural response in any organization but can be overcome through effective communication and training.

It’s important to address concerns and fears by emphasizing the benefits of cloud accounting software, such as increased efficiency and accuracy.

Involving employees in the decision-making process and providing opportunities for feedback and input can help reduce resistance.

Additionally, offering comprehensive training periods at multiple times and intervals ensures a smooth transition and minimizes disruptions.

This is important for large organizations where many people need to be trained on the solution, but conflicting schedules are a problem.

Recording and distributing training sessions and materials for later use and general employee reference is also a great idea if your provider allows it.

If not, they should have a large library of additional training and support materials your employees can reference.

How else does cloud accounting software impact the profitability of a SaaS company?

By now you should feel more confident about generating organizational buy-in for automation.

But there are two important advantages to cloud-based planning we haven’t discussed yet. Let’s take a look.

Real-time SaaS metrics with role-based dashboards

Real-time data in cloud accounting software empowers SaaS companies to make quick and informed decisions.

Role-based dashboards take that one step further by compiling all the metrics you need as a SaaS accounting leader into one simple, convenient screen.

Data is available in any currency, and customized dashboards are available for multiple roles, including CFO, Controller, and others.

Automated dashboards provide up-to-date financial information, enabling you to promptly identify trends and make strategic business decisions.

With real-time visibility into all your key metrics, you can optimize your performance and navigate your business successfully in any conditions by tracking revenue, expenses, and cash flow, aiding in your financial planning and forecasting.

Improving the customer experience to increase cash flow and cut churn rates

Cloud accounting software improves the customer experience by streamlining invoicing and payment processes.

Automated payment reminders and dunning emails ensure timely billing, minimize late payments, and reduce involuntary churn.

Additionally, advanced reporting and analytics features enable businesses to better understand customer behavior and preferences so you can tailor your products accordingly.

Give your software organization the gift of cloud accounting (in 9 easy steps)

The positive impacts of cloud accounting software for SaaS companies are undeniable.

It enhances decision-making with real-time data, improves the customer experience, and sets the stage for lasting growth and profitability.

Even if you know it’s time to upgrade from manual accounting, the process can still feel somewhat daunting.

If you’d like a simple 9-step guide to choosing the right planning solution for your company, check out our recent ebook for SaaS CFOs.

Ask the author a question or share your advice