Automating nonprofit revenue recognition for better compliance

In this article we cover how to achieve one of the most challenging accounting issues for many nonprofit organizations: nonprofit revenue recognition.

One of the most challenging accounting issues for many nonprofit organizations is nonprofit revenue recognition. The ability to produce accurate, compliant financial statements depends on performing proper nonprofit revenue recognition. In 2014, the Financial Accounting Standards Board (FASB) provided guidance for the recording of revenue from exchange transactions and contracts in ASU 2014-09 Revenue from Contracts with Customers (ASC Topic 606). However, many organizations interpreted these rules differently resulting in inconsistent reporting of nonprofit income.

Several years later, the FASB issued ASU 2018-08, Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made, to help nonprofits understand whether a transaction should be recorded as a contribution, a reciprocal transaction, or bifurcated revenue. To properly record revenue, nonprofits must determine who benefits from the funds, when should it be recognized based on conditions or restrictions, and what needs to be disclosed about the assumptions made in nonprofit revenue recognition.

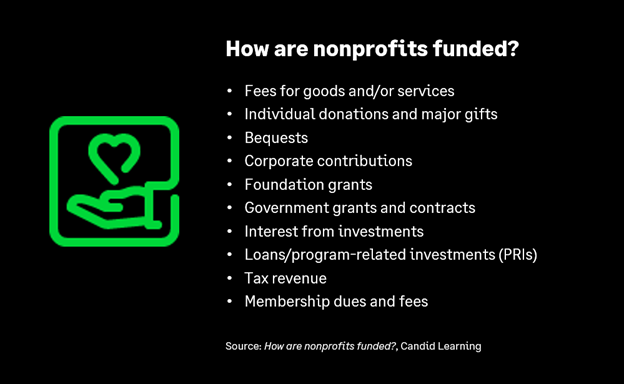

Since nonprofits receive many types of revenue streams including contracts, grants, memberships, tuition, and conditional and unconditional contributions, it is imperative that they are accurately recorded and tracked–and records are preserved for compliance. Following these FASB guidelines requires time and effort under the best circumstances. That is why many nonprofits use automated cloud-based accounting workflows to accelerate tasks, make consistent decisions, and capture detailed information for reporting and compliance.

This article will examine the framework for evaluating nonprofit revenue and provide guidance for determining how and when it should be recognized. Plus, we’ll share some examples of how automation helps you streamline compliance with nonprofit revenue recognition standards.

Pay close attention to diverse revenue sources for compliant nonprofit revenue recognition

In light of the updated FASB standards, nonprofit finance teams really need to understand how to account for revenue, apply the correct judgments about each revenue stream, and maintain compliance in their accounting and disclosures.

There are two key things to consider when grading revenue streams: materiality and timing. Materiality should be the first thing you consider since it determines if you are required to defer that revenue to stay in compliance with revenue recognition guidance. Once you’ve identified where your revenue comes from, you can look at your overall revenue stream and determine which ones are material.

When materiality is established, then consider the revenue timing.

- If it crosses over your year-end, then apply revenue recognition standards.

- If it’s an exchange transaction, apply ASC Topic 606.

- If it’s not an exchange transaction, then apply ASU 2018-08.

Automate exchange transaction recognition and streamline compliance with ASC Topic 606

With ASC Topic 606, FASB seeks to bring US GAAP standards for revenue recognition into closer alignment with international standards (IRFS), so there is greater clarity and consistency in treatment across nations, industries, and markets. When recognizing contract revenue, ASC 606 places the focus on when a good or service gets transferred to your customer; in other words, has your organization delivered what was promised to the customer?

There is also a greater focus on how nonprofit organizations record and report costs related to contractual fulfillment. That’s why nonprofit organizations must set a price or value to represent the performance obligations (good or service) required to complete the transaction. This is when automating nonprofit revenue recognition provides extra support to maintain compliance.

Nonprofit finance teams can simplify revenue recognition by choosing a financial management solution with functionality to configure and track contract details including milestones, resources consumed, costs incurred, and other performance measures. Using an automated, paperless workflow, nonprofit finance teams can document the accomplishment of contractual performance obligations over time or all at once after transferring a good or service to the customer. Once entered, this information is available in one click so staff and auditors have a single shared source of truth to streamline compliance of nonprofit revenue recognition.

Simplify nonprofit revenue recognition from contributions to maintain compliance with ASU 2018-08

Updated guidance in ASU 2018-08 was issued to eliminate confusion around revenue from contributions. The key focus now centers on the terms of the agreement and the point of entitlement. These updated standards require many nonprofits to run through a series of questions to determine reciprocity, donor-imposed conditions, and donor-imposed restrictions. The result of these determinations is what guides the timing of nonprofit revenue recognition.

Put simply, contributions are nonreciprocal, voluntary, and unconditional gifts. However, to maintain compliance with ASC 2018-08, nonprofit organizations need to document and track more information about these gifts to determine when to recognize that revenue:

- Contribution or reciprocal transaction? To determine if a transaction is reciprocal, ask yourself if there is any benefit the provider of the revenue is going to receive from your organization that is commensurate with the value of the contribution they plan to make. If yes, apply ASC 606. If no, proceed to the following steps for determining how and when to recognize revenue.

- Are there donor-imposed conditions on the contribution? Is there a right of return or a barrier that needs to be overcome in order to secure the gift? For example, has someone offered a matching gift only if your nonprofit organization secures $5,000 in contributions from other donors? If so, nonprofit revenue recognition occurs only after the performance obligation has been met.

- What about donor restrictions? It is important to differentiate between donor conditions and donor restrictions because, under the new guidance, donor conditions are the barrier in revenue recognition, not donor restrictions. A donor restriction assesses a limitation on the activity to be performed and unspent funds may have to be returned.

- How do you track bifurcated revenue? Some revenue types include a combination of earned revenue and contributions. These items require nonprofit finance teams to segregate different portions of the revenue and apply the correct guidance for each separately. For example, membership dues can be bifurcated if your organization produces a newsletter (exchange transaction) but any amount over and above the value of the newsletter is considered a contribution.

Imagine tracking all these details and decisions manually or across loads of spreadsheets. It’s a recipe for billing errors–whether it’s missing a qualified expense or overlooking a milestone that triggers when to recognize revenue. That’s why many nonprofit finance teams are using automated nonprofit revenue recognition tools to ensure they apply the correct standards and track all the details needed to ensure timely delivery of performance requirements and provide a clear audit trail for compliance.

“We used to spend about 60 hours per year to perform revenue recognition. With Sage Intacct, on a monthly basis, it now takes just 10 minutes—or one hour and twenty minutes total each year. Just think of that in terms of time utilization for your staff where they can use that time somewhere else.”

Braam du Plooy, Controller, Atlanta Convention & Visitors Bureau

Final thoughts

Let’s face it–ensuring compliance with nonprofit revenue recognition rules can be tricky and time-consuming. Donors, grantors, and members expect your organization to carefully track the conditions and restrictions imposed on their funding. Without these sources of revenue, your organization would not be able to successfully achieve its mission.

Automating nonprofit revenue recognition ensures compliance and helps ensure successful audits. Solutions like Sage Intacct deliver nonprofit revenue recognition and grant tracking solutions to help you achieve mission success with more control and visibility of your revenue streams.

To learn more, download the Nonprofit Revenue Recognition Simplified e-book.

Ask the author a question or share your advice