Want AI and automation for your practice? Here’s what you need to know

Do you want Artificial Intelligence (AI) and automation for your practice? You’re not alone. Accountants are broadly looking forward to a future where AI augments their workload. The majority – 66% – would invest in AI if it automated time-consuming and repetitive tasks.

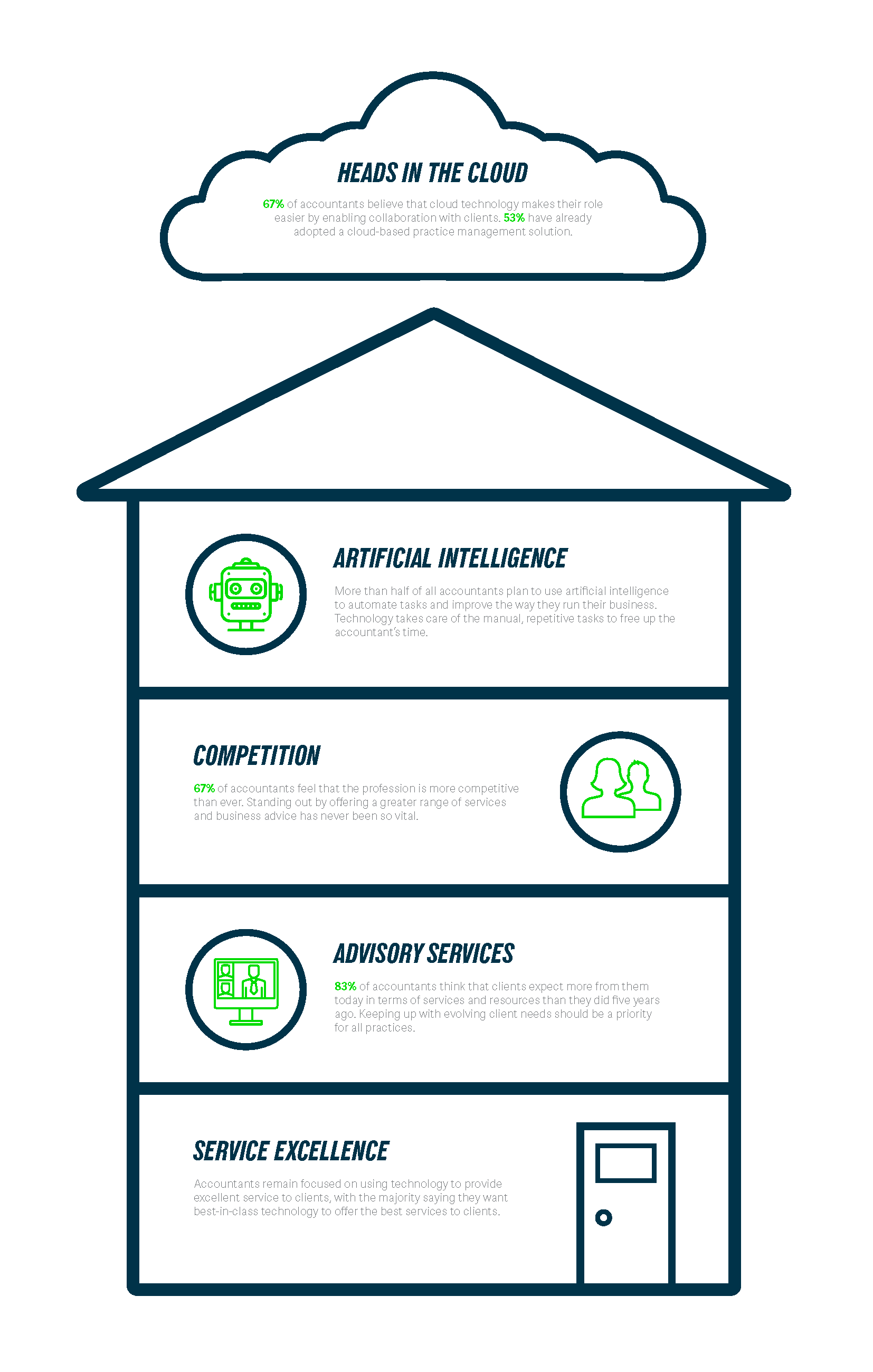

Independent research carried out by data collection agency Viga, on behalf of Sage, for the Practice of Now 2018 report spoke to 3,000 accountants worldwide to seek their opinions, with the findings forming a message from the near future for any accounting practice.

It’s with the small stuff that AI is initially likely to enter the profession, with it taking over many of the mundane tasks that are the bane of any accountant’s life. However, Kriti Sharma, VP of AI at Sage, says AI is also capable of superhuman processing that could lead to growth within practices.

Automation for your practice

“Accountants are seeing AI as purely an automation tool,” she says. “But the number of accountants who’d invest in AI will increase over the next two to three years as they start to see the true value of intelligence services.

“For example, accountants will be able to scale their operations by using AI to review millions of transactions that would have traditionally taken hours to do manually – spotting anomalies and making recommendations.”

All of this means that just like with cloud computing before it, accountants are likely to see more free time to be able to advise clients – which is one of the main drivers for people to enter the profession.

So, what advice is there if your practice is looking at a technological horizon featuring AI?

1. Don’t panic!

AI might be new but, when it comes to technological change, every accounting practice in the world has been through something similar before. From handheld calculators to cloud computing, the industry has been tied to technology in a three-legged race since the 1960s with each providing breakthrough vital functionality.

Perhaps surprisingly, you needn’t even expect the jolt of a technological speed bump with AI because the delivery vector will almost certainly be your existing accounting and client management software. Nope, you won’t be a robot alongside the photocopier any time soon!

In fact, in the initial stages at least, AI will be an extension of existing features you already use, and you might not even notice its presence. Perhaps that bank account reconciliation and coding starts to require noticeably less intervention on your behalf, for example, as machine learning starts to bite.

Your practice management software might become a little more proactive when it comes to assigning resources because it’s learned about seasonality and the flow of your client data.

“Artificial intelligence is more about augmenting human capabilities rather than replacing humans,” says Kriti.

2. Stay informed – and prepare now

Keeping abreast of technological change can be difficult but the fact you’re reading this article is a step in the right direction. You might also consider monitoring information coming from trade organizations both here and overseas.

For example, the ICEAW recently published a major report on AI within accounting. The ACCA also publishes articles about AI, such as this recent example.

However, it’s not just you personally who should be aiming to stay informed. You should be encouraging your colleagues to keep abreast of the changes because AI is likely to bring a cultural and institutional change within your practice.

As just one example, basic accounting tasks are often given to apprentices or trainees, yet with AI starting to take care of them it’s likely that newcomers to the industry will be starting at a fundamentally higher level. This is no bad thing – research has shown that young people entering the industry today have little tolerance for such tasks, which can lead to high staff turnover.

Again returning to the “don’t panic” advice above, remember that cultural and institutional changes will not be sudden and you might not even notice them at first. But they will come about and be prepared will be half the battle won.

AI needs to be seen in the context of earlier technology such as the cloud, from which we can learn much. This is the view of Jennifer Warawa, EVP of Partners, Accountants and Alliances at Sage, and a former accountant. She says “Those prepared to embrace new ways of working and evolve their business model really are reaping the benefits. There’s more opportunity than there is risk.”

3. Give it time

New technology requires that we invest time to make it all work, of course, and get the most out of it. But sometimes it needs more than this. It requires us to give it the benefit of the doubt. AI is going to take time to settle within the industry and as with any technology, we’re going to have to work to find the best way of exploiting it.

With AI within the accounting profession, this might be particularly acute because it’s likely that the technology will augment and enhance, and this means there’s also an on us as humans to adapt and indeed train ourselves as well as the AI.

And that initial need to train AI, especially in the lower-level examples of machine learning when taking care of the basic tasks, will again require patience – just as it would require patience to train a human.

In other words, the investment in AI is going to be more than technological or financial.

“Accounting is about certainty. Machine learning and AI is about probability. But at the end of the day, it’s all about productivity. It’s about how you can improve the client experience.” – Klaus-Michael Vogelberg, Chief Technology Officer at Sage.

Are you exploring how you can implement AI and automation for your practice? Let us know about your experiences in the comments below.

The Practice of Now (reference only)

Discover how accounting is on the brink of positive disruption and what accountants and bookkeepers can do to be successful.

Ask the author a question or share your advice