7 post-award grant management best practices for nonprofit organizations

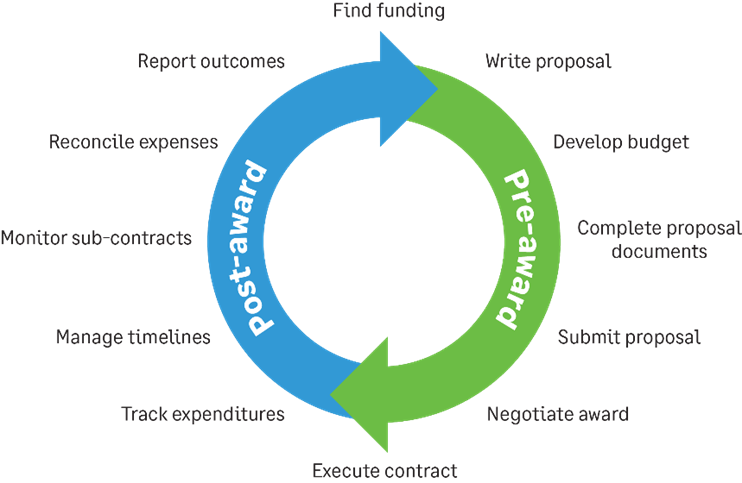

If your nonprofit organization utilizes grant funding, you know managing grants takes a lot of work. The grant management lifecycle has two parts—pre-award and post-award. Pre-award encompasses all the work that goes into earning a new grant.

First, you need to research different opportunities to find grants matching your organization’s mission and qualifications. Next, your team writes a proposal, develops a budget, fills out proposal documents required by the grantor, and submits the proposal package. Finally, if your organization is selected to receive funding, you must negotiate the reward and understand its terms and restrictions.

Each dollar of grant funding is hard-earned, so it is critical to institute impeccable fund management and ensure compliance with each grant. Doing so will help to build trust and credibility with the funder, increasing the odds you will win a renewal of the grant.

In this article, we will examine seven post-award grant management best practices to help you establish good relationships with grantors. You will want to have great processes and a strong financial management system in order to track expenditures, manage timelines, monitor sub-contracts, reconcile expenses, and report outcomes back to the grantor.

1. Build positive relationships with donors

Developing a good working relationship with your grantors greatly enhances your organization’s ability to earn grant renewals and increase the value of your grants with extensions.

These relationships are built on trust, accountability, and transparency, as well as a shared interest in your organization’s mission. The first few grants are the hardest to win. After you have an established track record, you are likely to get additional grants.

Make it easy for grantors to say yes by putting solid grant management processes in place. A nonprofit financial management system with good grant tracking, expense tracking, and reporting functionality can help you demonstrate strong fiscal discipline.

2. Manage restricted funds carefully

Most large grants are awarded with restricted funds, meaning your organization has specific obligations and instructions about how it can use the grant money. Failure to comply with the obligations is a missed opportunity to establish trust and earn a grant renewal.

To comply with grant restrictions, you will need to carefully track each grant and the status of funds, then record when conditions have been met for restrictions to be released. Some nonprofits try to track restricted funds with a spreadsheet, but organizations with significant grant funding need nonprofit accounting and grant management software to achieve the best level of accuracy and transparency.

“One of my favorite things about Sage Intacct is how we can track and report on grants and restricted contributions very easily and instantaneously with up-to-the-minute information.”

Robert Ehret, VP of Finance, Boys & Girls Club of Greater Tarrant County

3. Monitor revenue, spending, and the budget

Some grants provide the money up front, but the majority of grants pay out over time as the organization submits expenditures for reimbursement. It is very important to stay on top of expenses and cash flow in these situations. Become very familiar with the terms of your grant because you will need to know the expenditures you are making will qualify for reimbursement.

To manage grants effectively, you need real-time visibility into spending, cash flow, and budget-to-actual variance. That is the only way to accurately predict financial performance. Failing to track your budget and spending could result in a cash flow crunch if you overspend without a grant award to cover the full costs.

4. Capture your costs

In order to bill your grantors accurately, your organization needs a solid process for capturing both direct and indirect costs. You will need to capture expenses within your accounting system, mark them as reimbursable costs and associate the accounting entries for these expenses with the specific grants they should be billed under. By making this process as automated as possible, you can avoid reporting and billing errors and reduce the chance you will miss a charge or overstate an amount. Reduce the length of the billing cycle, so you can improve cash flow.

5. Automate grantor reporting

Most grantors require regular reporting, demonstrating accountability and transparency in the work your organization is doing. Reporting is a chance to further develop the important relationships between grantors and your organization. Try not to see reporting as a hoop to jump through. Instead, view it as an opportunity to establish a dialog and show funders how to support your mission.

When you have good financial automation, reporting does not need to be a chore. In fact, you should be able to easily customize reports to show grantors exactly the information they request.

Go beyond basic reporting requirements using automation to dig deeper into results while saving time. Include data visualizations, such as charts and graphs. Include outcomes and share stories of mission impact. Share any learnings that emerged during this phase of the grant and what new plans you are making as a result.

“Sage Intacct has really driven our ability to scale with 80% growth. There is no way we could have done that without Sage Intacct – it would have been insurmountable to track, manage, and report on all that data and in essence, 100+ grant ‘revenue centers.’”

Ben Luety, CFO, Seattle Indian Health Board

6. Track KPIs

Grantors want to know their funding is being spent wisely, in accordance with the grant conditions. They also want to know the money is having a demonstrable impact and helping you achieve your mission.

Being able to track key performance indicators (KPIs) and share them with your grantors is a great way to highlight the effectiveness of your team and programs. KPIs can monitor financial performance as well as outcomes.

Outcome metrics measure the impact of your program’s investment and provide an important level of accountability. Outcome metrics help you demonstrate that activities funded by your grantor yield the expected impact. Here are a few examples of outcome metrics:

It can be difficult to pull together the information to track critical KPIs without good nonprofit accounting software. But with the right automation, seeing real-time KPIs can be as easy as pulling up a dashboard.

7. Earn a clean audit opinion

An audit is a requirement for many grantors. Even those who do not require an audit are happy to see one conducted. A clean audit opinion is peace of mind for grantors and other funders. It adds the credibility of third-party financial expertise to your organization’s ethics, financial management, and good stewardship.

If your organization has implemented good accounting automation, it will be easier to work with an auditor. With a strong financial management system serving as a single source of truth, you will be able to easily provide reports and locate the information requested by the auditor. You can provide the auditor with access to your accounting system. Having an easy-to-search system and complete, accurate reporting will save the auditor time and may lower the cost of your audit.

“Sage Intacct is very helpful in meeting the compliance requirements of public funding grants. Our donors want to see that we receive a clean audit opinion. The internal controls in Sage Intacct are critical. The entire AP and AR cycles are now paperless with an audit trail and an automated approval process built right in.”

Faith Noble, CFO, Towards Employment

Further your mission by improving grant management

When you put these seven post-award grant management best practices to work in your organization, you will gain additional control, transparency, and insight into your grant seeking. By automating the grant management process, you will increase collaboration between the grants team, staff, and auditors. Combining best practices with nonprofit accounting and grant management automation can help your organization administer grants more effectively while complying with all requirements and restrictions.

Ask the author a question or share your advice