Not all carbon offsets are equal: a guide to help you pick the right schemes

Discover the world of carbon offsetting with this guide by our Climate science lead at Sage Earth.

Duncan Oswald CEnv FIEMA, Climate science lead at Sage Earth, looks at the complex world of carbon offsetting, giving you a guide on what to look out for.

We look at:

Sage Net Zero commitment and SBTi offsetting recommendations

Sage has made a commitment under the Science Based Targets initiative (SBTi) to be Net Zero by 2040.

SBTi doesn’t allow you to decarbonise using offsets, but they do accept that some emissions may never be eliminated, so up to 10% of your baseline emissions can be offset, once you have eliminated the other 90%.

The offsets that you can use for this purpose have to meet certain specific criteria:

“Companies shall remove carbon from the atmosphere and permanently store it to counterbalance the impact of any unabated emissions that remain once companies have achieved their long-term science-based target, and for subsequent years thereafter.”

The critical part of this requirement is that offsets must draw down emissions from the atmosphere (rather than acting to reduce additional emissions), and that their effect must be permanent.

Criteria for effective offsets

For any offset to be effective, there are a few other criteria that must also be delivered. Together with the SBTi requirements, these are summarised below:

Additionality

Additionality means offsetting activity wouldn’t have happened without the incentive provided by selling carbon credits.

An example of where this is not the case is those schemes where credits have been sold to protect forests from logging, where logging would have been illegal anyway because the forest was in a National Park.

Permanence

Permanence is referred to in the GHG Protocol with reference to “reversibility”.

The Protocol requires that “the risk of reversibility should be assessed, together with any mitigation or compensation measures included in the project design”.

Examples of offsets that have demonstrated reversibility (and therefore didn’t have permanence) include vast areas of plantations and protected forests on the US West Coast that have been destroyed in recent wildfires caused by climate breakdown.

Leakage

Leakage refers to a carbon offset project that may inadvertently result in greater emissions elsewhere.

Examples include:

- Forest protection initiatives that lead to increased logging outside the protected area

- Energy efficiency improvements that lead to an increase in production, and no reduction in emissions.

Double-counting

Double-counting is when 2 separate entities are sold the same carbon credit.

Buying carbon credits that are verified by an independent third-party verifier should prevent this.

Actuality

Actuality requires that carbon credits are generated by activities that have actually happened, rather than those that (probably) will happen in the future.

If you have emitted a tonne of carbon dioxide over the past year, offsetting it over the next decade doesn’t help, so it isn’t allowed.

This can occur in the case of tree planting or biochar projects as the activity that offsets the emissions (growing) happens after the offsets have been sold.

Commonly used offsetting schemes

Here are a few examples of commonly used offsetting schemes and reasons why they often don’t count:

Additionality

Many emissions avoidance (rather than carbon drawdown) schemes, such as:

- Renewable energy—it’s the cheapest form of energy, so why would you not build it anyway?

- Energy efficiency—did you do it to reduce emissions, or to save money?

- Avoided deforestation—can you be certain it would have been felled if you had not intervened?

Permanence

- Tree planting—how sure are you that the trees will grow, and that they won’t die or be burned down?

- Peatland restoration—with changing climate, how permanent is your restoration?

- Biochar—it might last for decades, but will it last forever?

Leakage

Schemes where activity can be displaced or increased, such as:

- Avoided deforestation—you might stop logging here, but are you just displacing it somewhere else?

- Energy efficiency—which can lead to increased production, and no net reduction in emissions.

Double counting

- Any project not verified by a reputable independent third party.

- Linked to permanence—have you been reimbursed for protected forests that burned down? Have you re-invested?

Actuality:

Has the scheme you’re paying for already achieved the carbon credits it’s selling? Such as:

- Tree planting

- Peatland restoration

- Biochar

- Avoided deforestation

- Advanced weathering

- Renewables—are offsets based on what fossil generation was actually displaced, or an exaggerated estimate of total emissions displaced by the project over its lifetime (e.g. IFI methodology)?

Problem areas for these types of projects

Have a look at any offset provider and see how many of their schemes fit these criteria:

- How many have already happened

- Would not have happened without your money

- Draw down historical emissions (rather than avoiding future emissions)

- Will last forever

- Will eliminate (not displace) climate impacts

- Are investment-grade reliable

Look at the carbon-credit rating systems (Gold Standard and Verra, for instance) in the same light:

The information they publish is often enough to reject schemes against the PAS criteria, even if it is rarely enough to approve them.

This isn’t to say that the projects these carbon credits fund are not worthwhile.

Many of them absolutely are.

They can have all manner of benefits, such as:

- Protecting and enhancing biodiversity

- Raising awareness

- Reducing future emissions.

But what very few of them do is offset the emissions caused by your business.

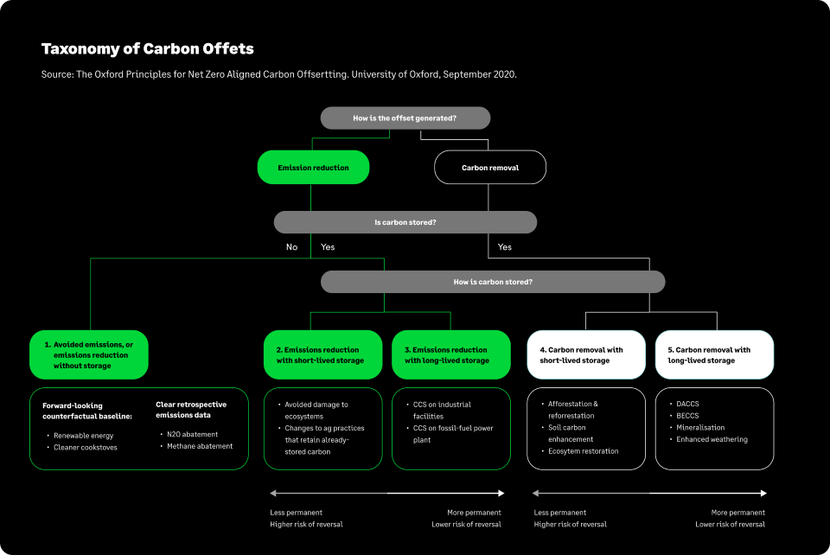

The Taxonomy of Carbon Offsets in accordance with the Oxford Principles

As the Taxonomy of Carbon Offsets from the Oxford Principles describes in the chart below, there is a hierarchy of offset quality.

To comply with SBTi, Category V offsets are required. But even within these constraints, other issues remain.

- On any meaningful scale, BECCS has unacceptable biodiversity and social impacts, and insurmountable leakage problems.

- Mineralisation and enhanced weathering are slow-acting, so the requirement that credits be historical creates problems. If you’re going to use this to offset residual emissions under SBTi, you’d better get started.

- CCS would work in principle, but it just hasn’t yet been implemented, and the energy requirements associated with this approach make it unlikely to be viable at scale.

As you can see, it can take some research to establish whether credits are effective in this regard. The Sage Earth platform will integrate carbon-credit research soon, but for now, you’ll be able to enjoy the accuracy of our automated carbon accounting and link the resulting footprints to robust and effective mitigation measures.

Offset projects to look into

So, within the constraints of Science Based Targets, what sort of projects can be used to offset residual emissions?

To a large extent, it depends on the specific details of the project.

And to a lesser extent, on what is available and how much you are prepared to compromise.

But some that definitely fit the bill include:

- Direct Air Carbon Capture and Storage

- Bio-oil reinjection

- Biochar (maybe; permanence is uncertain, and emissions can only be offset against regrowth)

- Enhanced Rock Weathering (but watch out for the lag; about 10% of the total offset happens in the first year, but 100% takes 20 years

Final thoughts

Carbon offsetting should not be used to balance out a businesses impact carbon impact, we have seen the SBTi framework suggest a maximum of 10% of emissions should be accounted for through this means.

Comprehensive research is essential to determine the effectiveness of carbon credits a business buys.

Projects such as Direct Air Carbon Capture and Storage, bio-oil reinjection, biochar, and enhanced rock weathering as potential offset options to look at in the first instance.

Not all offsets are created equal, so when you’re looking at your options, it’s important to look closely at what you are buying, make comparisons, and pick options that suit your overall mission the best.

Editor’s note: This article has been updated in July 2024.

Did you know that Sage has a new Carbon Accounting software solution?

If you use either Sage Business Cloud Accounting or Sage 50, Sage Earth can help you better understand your business’s environmental impact and guide you to net zero emissions.