How to calculate gross profit for your business

Gross profit should be an easy figure to calculate but its definition can give people a problem. However, if you want to get the rest of your figures right, this one comes first and it’s a crucial building block for you.

Gross profit is one of those great figures that gives you a quick snapshot of how your business is doing. It’s a rough guide, if you like, on your company’s performance and status, and it’s very useful.

However, arriving at the figure can cause some confusion, while it also doesn’t give the overall picture of how your company is performing, so some caution needs to be observed.

Getting a gross profit figure is, on the basic level, very easy to calculate.

Problems when working out gross profit

The confusion can first arrive because different businesses call their sales various things, the main three being “sales”, “turnover” or “revenue”.

For small businesses, the best term to use is “sales” – referring what your company actually sells.

The word “turnover” is often used by larger companies because it might incorporate sales of products, or other things such as recurring income (items billed every month), which are sales of course but can be defined in a slightly different way.

“Revenue” is a term more commonly used in the US. It’s the same as “sales”, although professional firms are bigger users of this term as they believe it better reflects their business than just the term “sales”.

However, whatever term you use, it comes down to what your company does to generate its cash. It’s the money you take, minus the money it costs to get the things that make you your money.

If you’re selling cans of cola, for example, your gross profit is the amount of money you take from your customers minus the amount it cost to buy the cans. So, if the retail price is £1 and you buy the cans from a wholesaler at 50p, then your gross profit is 50p.

Net position

Now, don’t forget that gross profit can also be a loss. So if you’re having a bad day and you’ve had to sell your cans of cola for 50p, the same as you bought them for, then you are at a net position. If you had to sell them for 40p, you are looking at a loss of 10p per can. Not a good place to be.

Ok so far? But the reason this gross profit figure is so important is that from here, your other figures are built. If you want to figure out net profits (arguably the key indicator of a company’s performance), then you take sales, minus the direct costs (as above). And from that figure, take away indirect costs (everything else that is a cost to your business – so rent, staff costs, postage, etc).

So, taking the number of cans of cola you sell in a year, take away from that the cost of those cans of cola from the wholesaler and then take from that the other costs that have allowed you to sell the cola in the first place (rent of your shop, utilities, transport, etc).

Get your calculations right

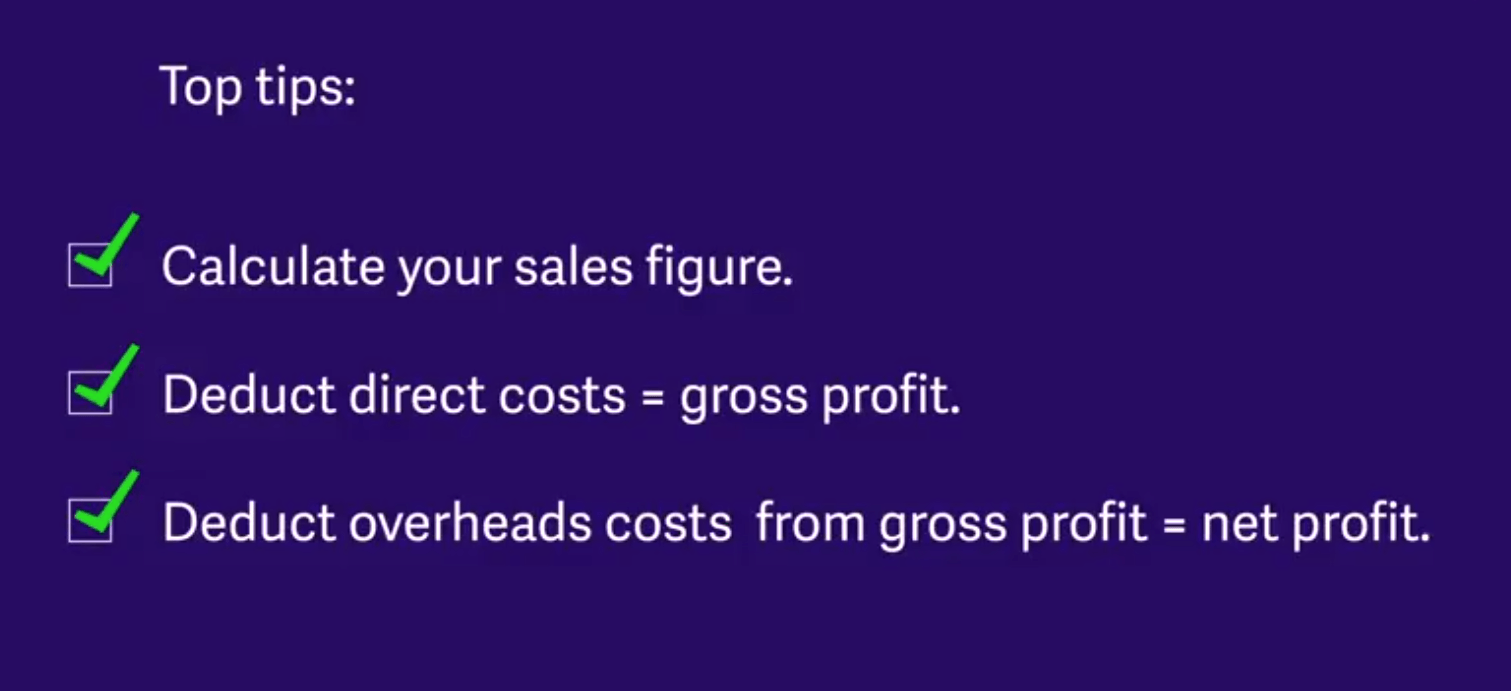

The thing to remember is that gross profit is sales minus direct costs, not sales minus every cost. Keep that in mind and you will be able to come to a gross profit figure every time.

And also remember that gross profit is your first calculation and as such, you need to get that right, otherwise your profit and loss account will not work, and you will not be getting the correct information about your business.

We asked Nicky Larkin for her opinion on how to understand gross profit. She’s the managing director and founder of Goringe Accountants, which is based in Reading and has around 700 clients. She is also chair of the Reading and West Berkshire branch of the Federation of Small Businesses (FSB).

Nicky has lots of experience of setting up finance teams and systems, managing all aspects of financial and management accountancy, installing best financial practice and gaining company financing.

She says: “We calculate gross profit from two key figures. You need your total sales – now of course some people call that different things, so don’t get confused, they are all the same thing, so it could be sales, revenue or turnover.

“Basically, whatever products or services you sell to your clients, then you take away your direct costs.

“Direct costs are the costs you have in your business that are directly attributable to your sales. So, for example, if you are selling cans of beer. It will be the cost of making those cans of beer, so that is a direct cost. So you would have your total sales less your direct costs equals your gross profit.

“That gross profit figure is really important because after that you take off your overheads to find out you net profit figure.”

Keep an eye on the accounts

We also spoke to The Dogfather, aka Dom Makin, who runs a dog walking and dog day care centre business in London. Originally from Wiltshire, his background was in advertising, a sector in which he worked for 16 years before he changed direction and went into dog walking.

He says: “We have very few overheads on our business which is quite good, we are always in gross profit.”

Dom is fortunate not to have many overheads because his is basically a service business, but as he grows and adds on products to complement his business, he will find that his direct costs will increase.

He adds: “When looking at gross profits, we’re in a fortunate position. Obviously I keep an eye on the accounts. I keep an eye on the money coming in, chase it up where it needs to be, so we’re in a fortunate position. As a business, we’re always in profit.”

So calculating gross profit doesn’t have to be a complicated affair after all. Follow the steps above and you’ll have some clarity over what your business is looking like financially.

A free guide to controlling your business costs

Our guide includes expert tips and advice to help beat the rising costs of being in business. It also shows you how insights about your spending can help the long-term health of your business.

Ask the author a question or share your advice