8 ways to get invoices paid without any awkward conversations

Awkward conversations when chasing late invoices are difficult. Get rid of them with our five tips to ensure your invoices get paid on time.

How long does it take for your customers to process your invoices and pay for your goods or services?

And how many awkward conversations do you have to have along the way?

It’s estimated that around 350 billion invoices are issued around the world each year.

But the average waiting time in the UK for invoices of £1m or less to be paid is 71 days, according to UK Finance (formerly known as the Asset Based Finance Association).

Sage’s own research reports that more than 1 in 10 are paid late. The research also found that across the world, the most common excuse given for late payments is… no reason at all.

How to avoid difficult conversations

As any business owner or finance professional knows, this can lead to tricky and often awkward phone calls or emails when a payment is overdue.

According to the same Sage research, for most businesses the biggest barrier to chasing payments is protecting the relationship with the customer or client.

“It’s difficult for small businesses to chase invoices,” says Sue Keogh, owner of Sookio, an award-winning digital marketing agency.

“When my business was smaller, somebody defaulted on an invoice for a lot of money. And I still haven’t received it. I’ve told my team that if ever I get the money then we’ll go off to an expensive hotel and drink Champagne all day.”

The worst aspect was that chasing the invoice took her away from her business. She says: “I took them to court. It was mentally draining. This is why it’s good to avoid these things happening in the first place.”

There are ways to sail the choppy waters of invoice payments for smaller businesses. Below are eight tips that should make those awkward conversations easier to navigate – or possibly remove the possibility of them ever arising in the first place.

1. Create an ‘accounts@’ email address

Most tips below revolve around a simple concept: use a professional mindset and approach when dealing with your business finances. Sometimes this can mean separating it from your day-to-day activities.

Most larger businesses have a separate credit control department. Why not emulate this?

OK, so your business might consist of only a few people (or just yourself), but you can set up an email address such as [email protected] or [email protected] to give the impression you have a separate section of your business devoted to your finances.

“This means you can continue your nice cosy relationship with the client via your usual email address,” says Keogh.

“And use your invoicing or accounts address for strict finance discussion.

“I’ve even heard of some businesses creating a fictional accounts person to use in the signature of that email account.

“But in any event, when using this email account, you should always write in the style of somebody in charge of finances and thereby keep things professional.”

Additional email addresses are easy to set up, and in most cases are free to operate. If you don’t know how to do so, speak to your internet service provider.

Most email clients such as Microsoft Outlook can be set up with more than one email account – but you should take care to select the right one each time.

Discover the new Sage Accounting

Try our award-winning accounting software for small businesses and sole traders. Get paid faster, track cash flow and automate admin to free up time to focus on the work that matters most.

2. Know who’s who – and who controls payments

It might seem sensible to invoice the individual who requested your services. But this can introduce delays.

They might sit on the invoice for a while before passing it to their manager, who then sits on it, before passing it to accounts payable.

And if there’s then a query with the invoice, it might be returned to you at that point – making you reissue the invoice and go through this waiting period all over again.

“Right at the start find out who handles paying invoices at the business,” says Keogh, adding that this is about more than simple expediency: “You want a good relationship with the person you’re working with.

“But handling invoices isn’t their highest priority. By discovering the processes of the business your work for, you’re removing any potential for friction. You make life easier for both them and you.”

Having this conversation can be intimidating, especially for smaller businesses. But doing so as early as possible when you start with a new customer or client gets it out of the way, and can be incorporated into general questions about the work you’re doing.

“Don’t hold back,” advises Keogh. “If an invoice isn’t paid on time, you’re bankrolling somebody else’s business. And that isn’t fair.”

3. Sync with payment runs

As part of your inquiries discussed earlier, try to find out when the business undertakes payment runs.

Some smaller businesses might process invoices on an as-needed basis, but larger businesses are likely to do so only once a month. This introduces delays because once invoices are processed, that’s when they apply their 30-day terms.

Something as simple as dating an invoice in the previous month can mean you don’t have to wait as long for payment.

For example, if you’re sending out an invoice on 1 June, and use that as the date, then the invoice might not get paid until late July – it will be processed as part of June’s payment run, and then paid once the terms are complete in July.

However, if you date the invoice 30 May then the business will probably process it as part of May’s payment run, which might mean payment arrives in June.

This trick can also influence when you should chase an invoice.

“I find large businesses often do a payment run on a Friday,” says Keogh. “So, it makes sense to chase an invoice at the beginning of the week, so you’re well in time.”

The payment run is often set to run automatically on Friday, often in the absence of staff responsible for it, so chasing any later in the week runs the risk of not only missing out on the run but also being unable to contact people who may be out of the office for various reasons.

This removes the need for the finance department to get immediately involved, which therefore removes further potential delays.

Read more about getting paid on time:

- How to change the way you manage your cash flow

- This is how to get paid on time

- 5 late payments rules you need to follow to get paid

- How to process an invoice

- Invoice cheat sheet: What you need to include on your invoices

4. Invoice immediately

If you take your time issuing an invoice, you send an implicit message to the customer or client that you don’t consider timely payment to be important either.

“People look for any excuse to wriggle out of paying an invoice,” says Keogh. “If you invoice late, they’ll put your invoice at the bottom of the pile, with the belief they don’t need to pay it soon.”

Sending an invoice late certainly won’t give you the strongest position should there be a requirement to contact the customer or client and chase the payment.

Issuing an invoice later rather than earlier can also create confusion for the customer or client, in that the time that’s elapsed might mean it’s not obvious what the invoice relates to.

The person controlling the purse strings may have to investigate, which adds yet more potential for delay until the payment is issued.

How soon should you send an invoice? Try immediately.

If you use a modern accounting software solution complete with a mobile app, you can even do this in front of the client.

Just completed a job or handed over some stock? Create and send the invoice there and then using a phone or tablet, and make sure the customer or client knows you’ve done so.

Following this, there can be no ambiguity about whether they received the invoice should you need to chase it up.

5. Offer many ways to pay

This point is a total no-brainer in the modern day and age. Any invoice your business issues must offer as many payment options as possible.

Try including credit card, debit card, bank transfer, PayPal, or even technologies such as Apple Pay or Google Pay. All should be offered in addition to the age-old methods of posting a cheque or arranging a bank transfer.

“Because of the coronavirus disruption, people are just a bit more open to doing things differently now,” says Keogh. “But make sure you mention on the invoice the ways they can pay.

“If it’s an electronic invoice, that’s as simple as providing a link.”

If you use modern accounting methods, your accounting software should let you include a ‘Pay Now’ button in the email invoice that lets the recipient settle the invoice with just a few clicks.

This makes it as convenient as possible for your client or customer to settle the invoice, thereby eradicating the potential for procrastination.

Should you find yourself having to chase the payment, any awkward conversations are lessened if you can demonstrate how you’ve tried hard to make it as easy as possible for your client or customer to make their payment.

Even business-to-business (B2B) companies, some of which still rely largely on cheques or BACS, are coming around to the idea of paying electronically via more contemporary methods.

Always ensuring your invoices offer this option is surely a step in the right direction.

Depending on the amount of the invoice, offering a variety of payment methods means it might even be possible for the person who authorised the purchase to pay it as an expenses claim.

This removes the need for the finance department to get immediately involved, which therefore removes further potential delays.

6. Know when invoices are read

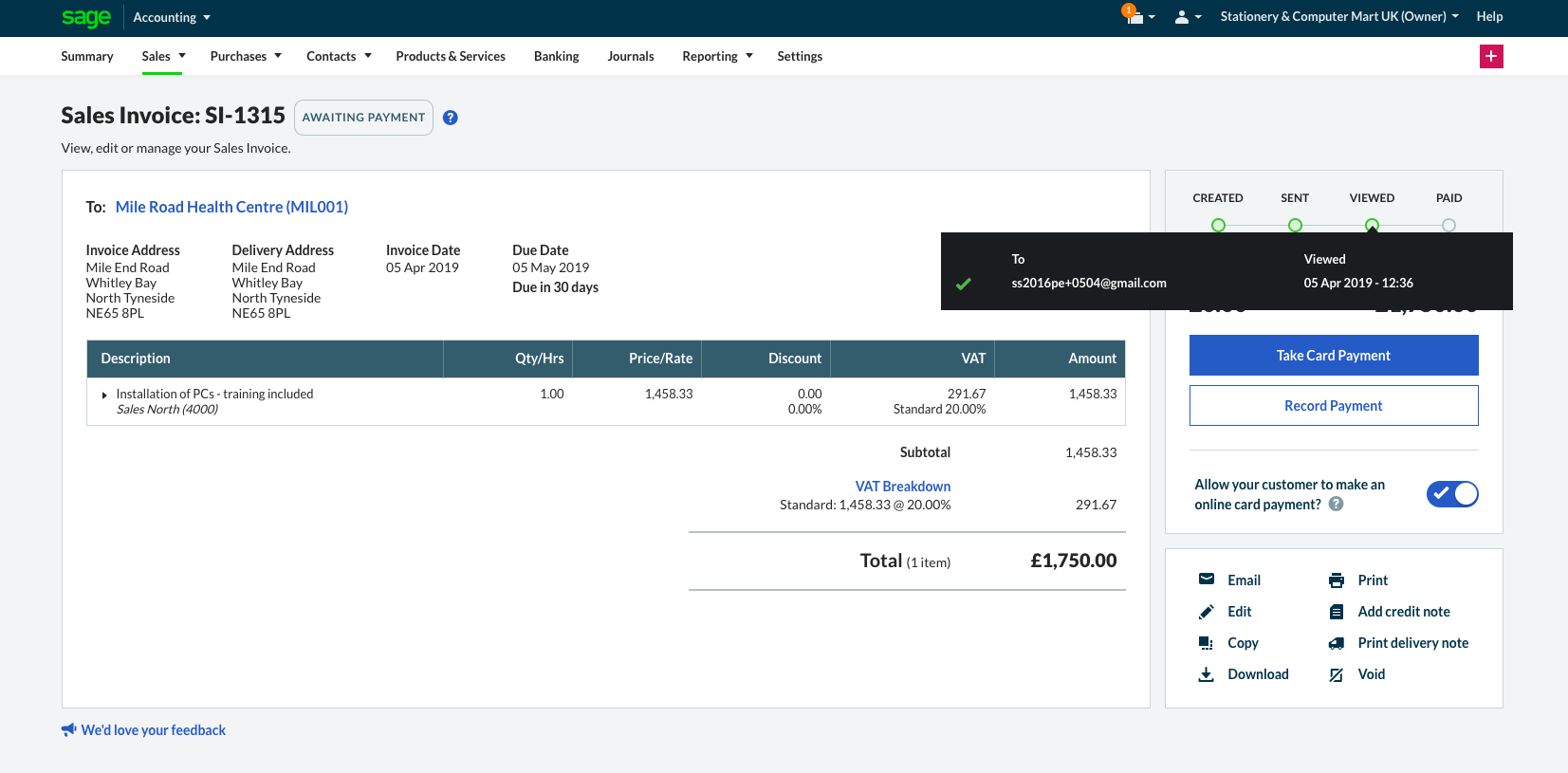

A cutting-edge feature in accounting software shows a document timeline for invoices. As well as showing exactly when you sent the invoice, it lets you know when invoices have been viewed by the recipient.

This works in a similar fashion to the way some email applications let you know when an email has been opened by the recipient. You’re even informed of the time and date the invoice was viewed.

“The earlier your business can implement something like this, the better it will be,” says Keogh. “Some small businesses put it off, thinking that they’re not yet big enough for this kind of accounts software. It will pay for itself quickly by reducing admin time.”

Document timelines can really help you during awkward conversations if the invoice requires chasing. If the client or customer says they didn’t receive it, you can explain not only that they did indeed receive it, but even tell them exactly when they did.

The fact that you can demonstrate the length of time since they became aware of the invoice should encourage them to settle it sooner rather than later because both you and they are aware the clock started ticking at that point.

Additionally, now they know your invoices can be tracked in this way, they’re less likely to delay paying them in the future.

“I haven’t used a paper invoice for about six years,” adds Keogh. “Back then, I would create them in a Microsoft Word document and then manually add it to my accounting software.

“But if somebody queried an invoice and I amended the document, I wouldn’t have a paper trail. I’d have to waste time looking through emails.”

7. Make invoices clear, accurate and attractive

There’s a handful of details that must be included on an invoice but, beyond this, a clear and presentable invoice is something that demands action on behalf of the recipient.

The more professional the invoice looks, the more professional a response it’s likely to engender in the recipient – and this means the invoice is more likely to be paid on time.

All of us are unaware of subconscious cues that dictate our actions and in our professional lives, we tend to respond to professionalism with our own level of professionalism.

Ensure you provide the information you have to on the invoice, but make sure any information the customer or client requires is also included, such as:

- The purchase order number.

- The name of the individual or department that placed the order.

- A concise description of what’s being invoiced for.

- Payment details.

This will help avoid delays when they’re processing it.

And make sure the key information is clear as you want it to be visible immediately.

“Make it easy for people to pay you,” says Keogh. “An invoice should be just a page, but we’re always trying to perfect and adjust our approach to find what works best.

“Keeping it simple helps to make clients feel welcome when they start working with you. You don’t want to send them confusing paperwork.”

Many accounting packages include a variety of invoice template designs that you can choose from. You might even choose to experiment with using each temporarily, to see which of them gets the best responses from your customers and clients in terms of timely payments.

8. Set up regular payments

If your business provides regular goods or services to a business on a repeatable basis, why not set up regular payments with the customer or client? Then you can be sure the money will be collected on the invoice due date.

It’s good for the customer or client, too, because they don’t have the administrative overhead each time of having to raise the payment.

Even the smallest businesses can create direct debits for their customers or clients using their accounting software and a provider such as GoCardless, Stripe or PayPal.

The charges are comparable with other forms of electronic payments but the benefits go way beyond just receiving regular payments without having to chase them.

Payments are automatically reconciled when received into your accounting software, so the background processing work requirement is also reduced.

Keogh says she uses direct debits or standing orders wherever possible, even if asking existing clients to switch can be difficult, with large clients simply unable to do so.

She says: “It’s easier with new clients because you set the expectations and can say, ‘Well, this is just how we work.’ And quite often I find the response is positive, because I tell them how they don’t need to worry about invoices.

“I tell them how they always get an automated email telling them the debit is about to happen.”

A direct debit setup for a client or customer doesn’t just need to be used for regular payments, of course. You can set one up and use it to claim payments as and when required on a semi-regular basis.

Again, the reduction of administrative overhead for both you and the client compared to traditional invoicing and payment collection can be very attractive.

Conclusion on getting invoices paid

Conversations with your customers or clients should be productive and proactive, rather than awkward and strained.

By using the techniques highlighted here, you should be able to turn around your invoice payments processes so awkward conversations to chase up money become a thing of the past, or at least less of a strain on your time and emotions.

Editor’s note: This article was first published in May 2019 and has been updated for relevance.

Small business toolkit

Get your free guide, business plan template and cash flow forecast template to help you manage your business and achieve your goals.

Ask the author a question or share your advice