What are Five Steps to Drive Your Company from Early to Growth Stage?

This article is originally published by BetaKit.

Whether fundraising or spending for scale, startup finance leaders are critical members of the team. While titles might be different depending on the size and stage of the startup, from CFO to VP Finance to Controller, the demands are similar: investors want to see a validated business model, and internal stakeholders want to know what brings in growth versus what burns cash.

Balancing the need for growth with day-to-day cash flow management can be nerve-wracking for finance leaders. For SaaS businesses, balancing these factors can be even more complicated, as there’s often a large time lapse between when a contract is signed, the invoice is sent, and cash comes in the door.

Bessemer Venture Partners is familiar with these challenges, from both its 200-plus investment portfolio, which includes Shopify, Twilio, and DocuSign, and in startups that pitch them for funding. Working with Sage Intacct, Bessemer Venture Partners has published a guide on how SaaS finance leaders can drive their companies from early to growth stage.

Showing the right foundation

At the early stages, startups must focus on validating their revenue model. From Bessemer’s perspective, a key metric for validation is if 75 percent of your sales team is able to hit their quota. That provides room for human error and learning, but offers confidence that things are going in the right direction.

Beyond hitting revenue targets, investors and internal stakeholders will want data to help them understand the quality of the revenue coming in the door. To measure revenue quality, Bessemer advises SaaS finance leaders to understand how repeatable their sales process is, have a grasp on unit economics, and ensure a clear, compliant financial foundation for the business.

From a financial perspective, a repeatable sales process is about the speed of your quote-to-cash process. Bessemer notes that a quick quote-to-cash process frees up salespeople to focus on selling more instead of chasing clients down that haven’t paid, which is key to scaling. From there, SaaS financial leaders need to show promising initial unit economics. In simplest terms, the report defines unit economics as “the time that it takes to earn back the cost of acquiring a customer,” which is calculated by dividing customer lifetime value (CLTV) by the cost to acquire a customer (CAC).

A repeatable sales process is in many ways a simple calculation: it’s just proving that you can acquire customers for less than they are worth. The challenge becomes understanding the data and leveraging real-time metrics. Matt Hodgson, CFO at Vidyard, calls this focusing on a “fully-loaded CAC,” which includes not just the salesperson’s salary but any other costs associated with closing a customer like support, onboarding, and even marketing resources.

With a real-time understanding of how quickly cash comes into the business from new sales and the unit economics of each customer, SaaS financial leaders need to focus on a solid financial foundation. Regulations such as IFRS 15 and other local compliance laws are best tackled early. Adding more and more contracts to a shaky foundation sets the company up for problems later on, which can impact the company’s ability to scale strategically or fundraise.

According to David Appel, the Head of SaaS and Subscription Verticals at Sage Intacct, one thing that early-stage startups should be aware of, but not totally prioritize, is churn analysis. Even though retaining clients is critical to long-term success, Appel cautions against focusing resources on tracking it early on, instead suggesting that it’s easy to keep an eye on while focusing on more critical foundations.

“When you’re small, you’re just so busy getting customers, they haven’t necessarily had time to leave you yet,” said Appel.

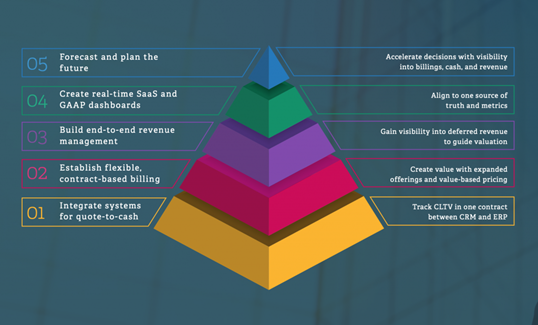

The report also lays out five steps for businesses to achieve their growth-stage goals.

Demonstrating a recurring revenue model

When SaaS startups enter the growth stage, which Bessemer defines as having raised around $10 million to date, financial leaders need to not just know salespeople can hit their quotas but explicitly prove a recurring revenue model. At this stage, investors and internal stakeholders alike are looking for financial insights that will drive big, bold moves to help the business scale. That involves demonstrating a deep understanding of CLTV, capital efficiency, and beginning to prioritize churn reduction.

According to the report, a critical element of demonstrating a high-quality CLTV is repeat buying.

“Investors want to see that you’re selling to customers a second and third time,” the report reads. “This may mean expanding your offerings. You also need to know the original contract, plus its performance obligations, so you can track and measure changes over time.”

In order to scale to the next level, repeat buying has to come with good capital efficiency. When bringing this analysis to light, financial leaders need to show the predictability of the business model and optimizations to unit economics. This is typically done by documenting “expenses by dimension as well as the expected billings, revenue, and cash, by customer,” according to the report. Unlike in the early stages, growth-stage companies need to have a handle on net and gross churn. This is especially important if the company has added additional products or services, as calculating net and gross churn for each service line and across the business can become incredibly complex.

Focus on getting the right data in

Unfortunately, knowing all the data doesn’t necessarily guarantee that your business will be successful, as the COVID-19 pandemic has proven. Appel said that SaaS finance leaders should focus on having the right data inputs, but beyond that, focus on scenario planning for a wide range of possibilities, up to and including a situation where whole product lines could drop to zero revenue overnight.

With the right data coming into the organization and scenario planning to understand best and worst-case scenarios, finance leaders are more able to provide the insights that internal stakeholders and investors need to make strategic decisions. But Appel cautions against jumping the gun on strategy, warning SaaS finance leaders to prioritize high-quality data infrastructure first.

“If you haven’t done infrastructure, you don’t have the data or can’t trust that it’s accurate,” said Appel.

Download the full report from Sage Intacct and Bessemer Venture Partners.

Ask the author a question or share your advice